AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

April 2024

Categories |

Back to Blog

Commodity Credit Corporation (CCC) commodity loans on harvested corn, soybeans and wheat were regularly used by farm operators in the 1990’s and early 2000’s as a grain marketing tool. The use of CCC commodity loans dropped off considerably from 2008-2014 and again from 2020-2022, when grain prices reached their highest levels in many years. As farmers finish up the 2023 harvest season, the use of marketing assistance loans (MAL’s), which are the same as CCC commodity loans, has again taken on more significance as an option in setting up post-harvest grain marketing plans for corn and soybeans.

The CCC commodity loans (MAL’s) are originated through county Farm Service Agency (FSA) offices after the grain has been harvested. The MAL’s are 9-month loans from the time the loan is established. A CCC commodity loan can be established both on farm stored grain and on grain in commercial storage with a warehouse receipt. Producers receive the value of the loan at the time the CCC loan is established. The loan can be repaid at any time during the 9-month loan period, by repaying the amount of the loan principal plus the accrued interest. The 2018 Farm Bill established national loan rates for the various commodities that are eligible for the marketing assistance loans. Following are the 2023 national loan rates for common crops in the Upper Midwest: · Corn --------- $2.20 per bushel · Soybeans --- $6.20 per bushel · Wheat ------- $3.38 per bushel · Barley ------- $2.50 per bushel · Oats --------- $2.00 per bushel · Grain Sorghum --- $2.20 per bushel The county loan rates are then adjusted higher or lower than national rates, based on local commodity price differentials compared to national price levels. Following is the range of county corn and soybean loan rates for MAL’s in the Upper Midwest States: · Minnesota -------- Corn = $2.02 to $2.13/bu.; Soybeans = $5.82 to $6.15/bu. · Iowa --------------- Corn = $2.07 to $2.30/bu.; Soybeans = $6.07 to $6.32/bu. · Nebraska ---------- Corn = $2.05 to $2.27/bu.; Soybeans = $5.82 to $6.18/bu. · South Dakota ----- Corn = $2.04 to $2.21/bu.; Soybeans = $5.67 to $6.10/bu. · North Dakota ----- Corn = $1.99 to $2.20/bu.; Soybeans = $5.67 to $5.97/bu. · Wisconsin --------- Corn = $2.03 to $2.20/bu.; Soybeans = $6.10 to $6.29/bu. The MAL loan interest rate is adjusted monthly and is set up at one percent above the CCC borrowing rate from the U.S. Treasury. The interest rate on MAL loans is fixed for the entire term of the 9-month MAL, except for a potential CCC interest rate adjustment on January 1. The current interest rate on marketing assistance loans (as of 11-01-23) was 6.50 percent, which compares to an interest rate of 8 to 9 percent for short-term financing at many commercial ag lending institutions. Producers only pay interest for the time that the MAL is in place. (Example --- $200,000 MAL corn loan at 6.50% interest for 180 days …… ($200,000 x .0675) / 365 x 180 = $6,411 interest payment for 6 months). Farm operators have the flexibility to place grain under a MAL at a local FSA office any time after the grain has been harvested. Producers also have the flexibility to treat the commodity loan as either “income” or as a “loan” when the loan proceeds are received. This can have income tax implications, depending on how and when the loan proceeds are received. It is best to consult with a tax consultant before determining the timing and the preferred method of receiving the loan proceeds. If commodity prices drop to levels that are lower than county loan rates, eligible producers would potentially be eligible to release the grain that is under a marketing assistance loan at a rate that is lower than the county loan rate. FSA issues a “posted county price” (PCP) for commodities that are eligible for MAL’s, which are updated and posted daily at local FSA offices, or available on county FSA websites. If the PCP is lower than the county loan rate, the producer could realize a “marketing loan gain” (MLG), if the grain is released at that lower PCP. (Example --- a producer places corn under a MAL at $2.10 per bushel, a few months later the PCP is $1.90 per bushel, resulting in the potential of a marketing loan gain of $.20 per bushel on the day the corn loan is released.) If the PCP drops below the county MAL loan rate, producers also have the option to collect a loan deficiency payment (LDP) on a commodity, in lieu of putting the grain under a commodity loan. The LDP calculation is similar to the calculation for marketing loan gains. Grain that is already under a commodity loan is not eligible for a LDP, and a LDP can only be utilized once on the same bushels of grain. There has not been significant LDP eligibility for corn and soybeans since the early 2000’s and we do not anticipate any LDP opportunities for the 2023 corn and soybean crop that is being placed in storage. Producers must be eligible for USDA farm program benefits and must have submitted an acreage report at the FSA office for 2023 to be eligible for marketing assistance loans on this year’s crop production. Producers must maintain “beneficial interest” in the grain while it is under a MAL. Beneficial interest means that the producer maintains control and title of the commodity while it is under a commodity loan. Producers should contact their local FSA office to release any grain that is under a marketing assistance loan before it is delivered to market (“call before you haul”). Following are some reasons that farm operators may want to consider utilizing marketing assistance loans (MAL’s) as part of their grain marketing strategies: · Provides short-term credit at relatively low and stable interest rates. · Loan funds can be used to pay post-harvest expenses and land rental payments for the current year or for prepaid crop inputs (seed, fertilizer, etc.) for the following crop year. · Loan funds can also provide the necessary funds to make year-end or January principal and interest payments on term loans and real estate loans. · Allows a producer to receive partial compensation for corn and soybeans during or following the Fall harvest season, when commodity prices are traditionally lower than average. · Allows a producer the flexibility to market the grain in future months after the grain has been placed under a MAL, including forward pricing the grain for future delivery (remember that the commodity loan must be satisfied at the FSA office before the grain is delivered.) · Commodity loans can also be used by livestock producers that plan to feed the corn or other grain, which is followed by just releasing the grain that is under loan as it is fed to livestock. · If commodity prices decline below the county CCC loan rates, the grain that is under loan can be released at the lower price, or producers can collect a loan deficiency payment (LDP). For further information on USDA marketing assistance loans (MAL’s) and county loan rates for various commodities, farm operators should contact their local FSA office, or go to the following website: https://www.fsa.usda.gov/programs-and-services/price-support/Index Note - For additional information contact Kent Thiesse, Farm Management Analyst and Sr. Vice President, MinnStar Bank, Lake Crystal, MN. (Phone - (507) 381-7960) E-mail - kent.thiesse@minnstarbank.com) Web Site - http://www.minnstarbank.com/

Back to Blog

The monthly USDA World Supply and Demand Estimates (WASDE) Report that was released on October 12 will likely impact corn and soybean markets in the coming months. The WASDE Report decreased the estimated 2023 corn and soybean yield and the corresponding 2023 production estimates. There was a slight decrease in the expected U.S. corn ending stocks by the end of the 2023-24 marketing year, as compared to the September estimate; however, the projected soybean ending stocks for 2023-24 remained the same as a month earlier.

The latest WASDE report showed an increase in total demand levels for corn during the 2023-24 marketing year, as compared to 2022-23 levels. Total corn usage for 2023-24 is now estimated at 14.34 billion bushels, which is down slightly from the September estimate and compares to total corn usage of nearly 13.77 billion bushels for 2022-23. The increased corn usage estimates are mainly due to a projected increase in corn export levels and corn used for ethanol production in the coming year. The total 2023-24 soybean usage is estimated at 4.18 billion bushels which is down from 2022-23 levels, mainly due to a projected decrease in export levels. The October WASDE Report showed a slight decrease the estimated U.S. corn ending stocks for the 2023-24 marketing year, as compared to the September report. The 2023-24 corn ending stocks are now estimated at 2.11 billion bushels which compares to 1.36 billion bushels for 2022-23. It also compares to previous year-end corn carryout levels of 1.38 billion bushels in 2021-22, 1.23 billion bushels in 2020-21, and 1.99 billion bushels in 2019-20. The 2023-24 U.S. corn ending stocks-to-use ratio is now estimated at 14.7 percent, compared to the much tighter ratios of ratios of 9.9 percent in 2022-23, 9.2 percent in 2021-22, and 8.3 percent for 2020-21. The projected 2023-24 ratio is comparable to the ratios of 14.4 percent in 2019-20 and 15.5 percent for 2018-19. The wider stocks-to-use ratio may limit the potential for rallies in the cash corn market in the coming months. The 2023-24 U.S. soybean ending stocks in the latest WASDE Report were estimated at 220 million bushels, which is the same as the September USDA report. The projected 2023-24 carryover level is lower than the estimated final ending stocks of 268 million bushels in 2022-23 and 274 million bushels in 2021-22, as well as considerably below some other recent carryover levels of 523 million bushels in 2019-20 and 909 million bushels in 2018-19. The U.S. soybean ending stocks-to-use ratio for 2023-24 is estimated at 5.3 percent, which remains at a fairly tight level. The 2023-24 projected ending stocks ratio compares to 6.2 percent for 2022-23, 6.1 percent for 2021-22 and 5.7 percent for 2020-21; however, the 2023-24 ratio would be well below the ratios 13.2 percent ratio for 2019-20 and nearly 23 percent for 2018-19. The expected tight degree of projected soybean ending stocks for 2023-24 will likely help support short-term soybean prices in the coming months; however, continued market strength may depend on 2024 South American soybean production and continued solid export markets. USDA is estimating the U.S farm-level cash corn price for 2023-24 at an average of $4.95 per bushel, which was up $.05 per bushel from the September estimate. The 2023-24 USDA price estimate is the expected average farm-level price for the 2023 crop from September 1, 2023, through August 31, 2024; however, this does not represent estimated prices for either the 2023 or 2024 calendar year. The projected 2023-24 average corn price compares to final market-year average corn prices of $6.54 per bushel for 2022-23, $6.00 per bushel for 2021-22, $4.53 per bushel for 2020-21, $3.56 per bushel for 2019-20, and $3.61 per bushel for 2018-19. USDA is projecting the U.S. average farm-level soybean price for the 2023-2024 marketing year at $12.90 per bushel, which is the same as the September estimate. The 2023-24 soybean price estimate compares to the estimated 2022-23 average price of $14.20 per bushel, would was the highest average price in several years. Other final market-year average soybean prices were $13.30 per bushel for 2021-22, $10.80 per bushel for 2020-21, $8.57 per bushel for 2019-20 and $8.48 per bushel in 2018-19. USDA Lowers 2023 Corn and Soybean Yield Estimates The monthly USDA Crop Production Report was also released on October 12. USDA reduced the expected 2023 national average corn yield by eight-tenths of a bushel and decreased the projected 2023 U.S. average soybean yield by five-tenths of a bushel per acre as compared to the September report. The latest estimated 2023 national corn yield is only four-tenths of a bushel per acre lower than the final 2022 average yield, while the projected U.S. average soybean yield for 2023 is the same as the final 2022 national soybean yield. USDA is estimating the 2023 national average corn yield at 173 bushels per acre, which compares to 173.4 bushels per acre in 2022. The projected 2023 U.S. corn yield also compares to the record U.S. corn yield of 176.7 bushels per acre in 2021, 171.4 bushels per acre in 2020, and 168 bushels per acre in 2019. The estimated 2023 U.S. harvested corn acreage is 87.1 million acres, which is well above the 79.1 million acres that were harvested last year. The latest USDA Report estimated the total U.S. corn production for 2023 at just over 15 billion bushels, which is almost 10 percent above the production level of 13.71 billion bushels in 2022. The anticipated 2023 corn production would be the third highest on record and compares to levels of 15.1 billion bushels in 2021, 14.1 billion bushels in 2020, and the record U.S. production of 15.15 billion bushels in 2016. USDA is estimating 2032 U.S. soybean yield at 49.6 bushels per acre, which compares to 50.1 bushels per acre in 2022, 51.7 bushels per acre in 2021, 51 bushels per acre in 2020, 47.4 bushels per acre in 2019, and the record U.S. soybean yield of 52.0 bushels per acre in 2016. The harvested soybean acreage for 2023 is estimated at 82.8 million acres, which is down from 86.2 million acres in 2022 and 86.3 million acres in 2021; however, it is similar to the 82.6 million harvested acres in 2020. The USDA Report estimated 2023 U.S. soybean production at just over 4.1 billion bushels, which trails the production levels of 4.27 billion bushels in 2022, 4.46 billion bushels in 2021, and 4.22 billion bushels in 2020. The October USDA Report increased the expected 2023 corn yield in some States and lowered yield expectations in other States, compared to the September Report. Minnesota is projected to have a 2023 corn yield of 179 bushels, which compares to the state record yield of 195 bushels per acre in 2022, 177 bushels per acre in 2021, and 191 bushels per acre in 2020. USDA is estimating the 2023 Iowa corn yield at 199 bushels per acre, which compares to 200 bushels per acre in 2022 and the state record yield of 204 bushels per acre in 2021. States with projected strong average corn yields for 2023 include Illinois at 200 bushels per acre, which compares to record corn yield of 214 bushels per acre in 2022; Indiana at 197 bushels per acre, compared to 190 bushels per acre in 2022; and Ohio at 195 bushels per acre, compared to 187 bushels per acre in 2022. States with more modest corn yield estimates for 2023 include Nebraska at 174 bushels per acre, compared to 165 bushels per acre in 2022; South Dakota at 147 bushels per acre, compared to 132 bushels per acre in 2022; North Dakota at 136 bushels per acre, compared to 131 bushels per acre in 2022; and Wisconsin at 165 bushels per acre, compared to 180 bushels per acre in 2022. USDA is estimating the 2023 Minnesota soybean yield at 48 bushels per acre, which compares to 50 bushels per acre in 2022, 47 bushels per acre in 2021, and the record yield of 52.5 bushels per acre in 2016. Iowa is projected to have a 2023 soybean yield of 58 bushels per acre, compared to 58.5 bushels per acre in 2022 and the record yield of 63 bushels per acre in 2021. Other States with solid projected soybean yields for 2023 include Illinois at 61 bushels per acre, compared to 63 bushels per acre in 2022 and the record yield of 65 bushels per acre in 2021; Indiana at 61 bushels per acre, compared to 57.5 bushels per acre in 2022; Ohio at 57 bushels per acre, compared to 55.5 bushels per acre in 2022; and Nebraska at 54 bushels per acre, compared to 49 bushels per acre in 2022. Projected 2023 soybean yields in other upper Midwest States include South Dakota at 43 bushels per acre, compared to 38 bushels per acre in 2022; North Dakota at 33 bushels per acre, compared to 35 bushels per acre in 2022, and Wisconsin at 44 bushels per acre, compared to 54 bushels per acre in 2022.

Back to Blog

T

he September 12 USDA Crop Report decreased the projected U.S. average corn and soybean yields for 2023, as compared to the August National Ag Statistics Service (NASS) yield estimates; however, that was offset by increases in the expected 2023 harvested acreage for both crops. The latest NASS yield estimates were based on U.S. crop conditions as of September 1st; and were the first 2023 USDA yield estimates that included actual field data, including in some of States with major impacts from this year’s drought. Total U.S. corn and soybean harvested acreage totals were increased in the latest USDA report, compared to the August acreage estimates. The increase in acreage resulted from less-than-expected prevented planted acres in 2023. The end-result was a slight increase in the expected total 2023 corn production and a slight decrease in the estimated 2023 soybean produc-tion. The immediate market response was a price decline for both December corn futures and November soybean futures on the Chicago Board of Trade (CBOT). The September 12 USDA Report projects the 2023 U.S. average corn yield at 173.8 bushels per acre, which is a decline from 175.1 bushels per acre in the August USDA report. The projected 2023 national corn yield compares to 173.3 bushels per acre in 2022 and the record U.S. corn yield of 177 bushels per acre in 2021, as well as to 171.4 bushels per acre in 2020 and 167.4 bushels per acre in 2019. USDA increased the total 2023 harvested corn acreage in the U.S. by 774,000 acres from earlier estimates, based on crop acreage certification data filed by producers through the USDA Farm Service Agency (FSA) offices. USDA is now estimating total U.S. corn production for 2023 at just over 15.13 billion bushels, which would be an in-crease of 10 percent from the 2022 production level of 13.73 billion bushels and would be similar to the 2021 production of 15.1 billion bushels. USDA is estimating Minnesota’s 2023 average corn yield at 180 bushels per acre, which was a decrease of 3 bushels per acre from the August esti-mate. The projected 2023 corn yield compares to the 2022 record yield of 195 bushels per acre and the 2021 average yield of 178 bushels per acre. The September 12 report also decreased Iowa’s 2023 average corn yield by 3 bushels per acre compared to the August estimate, lowering the project-ed yield to 200 bushels per acre. Iowa’s projected 2023 statewide corn yield would be the same as the final 2022 yield and compares to 205 bushels per acre in 2021. The 2023 USDA corn yield estimates for the major corn producing states in the eastern corn belt are Illinois at 198 bushels per acre, compared to 214 bushels per acre in 2022; Indiana at 194 bushels per acre, compared to 190 bushels per acre in 2022; and Ohio at 195 bushels per acre, compared to 187 bushels per acre in 2022. Several western corn belt states showed higher yield estimates for 2023, including Nebraska at 177 bushels per acre, compared to 165 bushels per acre in 2022, South Dakota at 146 bushels per acre, compared to 132 bushels per acre in 2022, and North Dakota at 138 bushels per acre, compared to 131 bushels per acre in 2022. The 2023 yield estimate for Wisconsin is 165 bushels per acre, compared to 180 bushels per acre in 2022. It should be noted that of the states listed, only Ohio, North and South Dakota showed an increase in the corn yield projec-tion on September 1 compared to August 1. All other listed states listed showed a decline in the corn yield estimate. The USDA Report on September 12 estimated total 2022 U.S. soybean production at just under 4.15 billion bushels, which would be down slightly from the 2022 soybean production of slightly below 4.28 billion bushels. USDA lowered the projected 2023 U.S. average soybean yield to 50.1 bushels per acre from 50.9 bushels per acre in the August report. The 2023 NASS soybean yield estimate compares to final U.S. soybean yields of 49.5 bushels per acre in 2022, 51.4 bushels per acre in 2021, and 50.2 bushels per acre in 2020. The record national average soybean yield was 52 bushels per acre in 2016. The USDA 2023 soybean yield projection was slightly higher than the average yield estimates by many grain trading ana-lysts, which is pressuring soybean prices. USDA is estimating Minnesota’s 2023 average soybean yield at 48 bushels per acre, which is down one bushel per acre from the August estimate. The 2023 yield projection compares to recent statewide yields of 50 bushels per acre in 2022, 47 bushels per acre in 2021, and 49 bushels per acre in 2020, as well as the record statewide soybean yield of 52.5 bushels per acre in 2016. The estimated 2023 soybean yield for Iowa is at 58 bushels per acre, which is the same as the August projected yield. The 2023 estimated yield compares to 58.5 bushels per acre in 2022, the record statewide soy-bean yield of 62 bushels per acre in 2021, and 53 bushels per acre in 2020. The projected 2023 yields in major soybean producing eastern corn belt states include Illinois at 61 bushels per acre, compared to 63 bushels per acre in 2022, Indiana at 60 bushels per acre, compared to 57.5 bushels per acre in 2022; and Ohio at 58 bushels per acre, compared to 55.5 bushels per acre in 2022. Similar to corn, soybean yields in Nebraska and South Dakota are expected to increase significantly in 2023, compared to the drought-reduced soybean yields in 2022. The 2023 Nebraska soybean yield is estimated at 55 bushels per acre, compared to 49 bushels per acre in 2022, with South Dakota projected at 43 bushels per acre in 2023, compared to 38 bushels per acre in 2022. The 2023 projected soybean yield of 46 bushels per acre in Wisconsin is considerably lower than the final yield of 54 bushels per acre in 2022, while the 2023 yield of 33 bushels per acre in North Dakota is only slightly below the final yield of 35 bushels per acre in 2022. SEPTEMBER 12 WASDE REPORT The USDA World Supply and Demand Estimates (WASDE) that was also released on September 12. The report included the projected decreases in the 2023 U.S. corn yield and corn production that were referenced earlier. The report projects increased corn usage for ethanol and livestock feed dur-ing 2023-24 marketing year, as compared to the 2022-23 corn usage levels. U.S. corn export levels for 2023-2024 are estimated at 2.050 billion bushels, which is up from the estimated export total of 1.665 billion bushels for 2022-23. The 2023-24 corn export level would still trail the strong export totals of 2.472 bushels in 2021-22 and 2.745 billion bushels in 2020-21. The U.S. corn ending stocks for 2023-24 are projected at 2.22 billion bushels, which would be an increase of 53 percent from the estimated carryover of 1.452 billion bushels for 2022-23. The latest 2023-24 corn ending stocks projection would also be considerably higher than the final corn carryover levels of 1.38 billion bushels in the 2021-22 marketing year, and 1.23 billion bushels in 2020-21. The higher projected 2023-24 corn ending stocks are putting considerable pressure on corn price projections for the 2023-24 marketing year, which extends from September 1, 2023, through August 31, 2024. USDA is estimating the average on-farm corn price for the 2023-24 marketing year at $4.90 per bushel, which is the same as the August report. The 2022-23 national average corn price, which will be finalized on September 30, 2023, is estimated at $6.55 per bushel, which compares to previous final national average prices of $6.00 per bushel in 2021-22, $4.53 per bushel in 2020-21, $3.56 per bushel in 2019-20, and $3.61 per bushel for 2018-19. The recent WASDE report projected 2023-24 soybean ending stocks at 220 million bushels, which is a decrease of 25 million bushels from the August estimate. The 2023-24 estimated soybean ending stocks compare to previous ending stocks of an estimated 250 million bushels for 2022-23, 274 million bushels in 2021-22, and 257 million bushels in 2020-21. Soybean exports for 2023-24 are projected at 1.79 billion bushels, which is down from an estimated 1.99 billion bushels in 2022-23 and 2.15 billion bushels in 2021-22. USDA is now projecting the average on-farm soybean price for the 2023-24 marketing year at $12.90 per bushel, which is an increase of $.20 per bushel from the August price estimate. The 2022-23 estimated final national average soybean price is estimated at $14.20 per bushel, which compares to national average prices of $13.30 per bushel in 2021-22, $10.80 per bushel for 2020-21, and $8.57 per bushel for 2019-20. Note - For additional information contact Kent Thiesse, Farm Management Analyst and Sr. Vice President, MinnStar Bank, Lake Crystal, MN. Phone (507) 381-7960. E-mail kent.thiesse@minnstarbank.com) Web Site - http://www.minnstarbank.com

Back to Blog

FARM BILL EXTENSION APPEARS LIKELY9/6/2023 Even though Congress has held multiple hearings and listening sessions during the past several months, it does not appear likely that we will have a new Farm bill in place when the current Farm Bill expires. The current Farm Bill, known as the “Agriculture Improvement Act of 2018”, expires on September 30, 2023, and included coverage of the 2023 crop year. At this point, no formal legislation for a new Farm Bill has been proposed in either house of Congress. Once a formalized Farm Bill is proposed and discussed, it will need to be passed by both houses of Congress and signed by President Biden before it can be enacted. Most likely, much of the funding allocated in the current Farm Bill will be extended through pending actions by Congress on the Federal budget.

When most people hear of a “Farm Bill”, they think of the commodity programs and payments that affect crop producers. Some people may be aware that crop insurance and conservation programs are included under the Farm Bill, and some are knowledgeable that Supplemental Nutrition Assistance Program (SNAP) and food stamps are part of the Farm Bill legislation. However, very few people outside of government officials and policy experts are aware that the Farm Bill also covers funding for rural fire trucks and ambulances, export promotion, international food aid, forestry programs, ag research and extension education at land-grant universities, and school lunch programs. The current Farm Bill passed in 2018 was over 1,000 pages in length, and contains 12 separate Titles, which cover a multitude of programs that are administered by USDA. Farm Bills date back to Great Depression era of the 1930’s, with the first Farm Bill having just two Titles and being only 54 pages in length. The “Agricultural Adjustment Act of 1933” established the crop loan program, which is still in existence today. Under the crop loan program, producers can take out a low interest loan with USDA, using the crop as collateral before it is sold. The producer can either repay the loan principal plus interest when the crop is sold or can forfeit the crop to USDA. Over the past several decades, the crop loan program has been used extensively by farm operators to get needed working capital for purchasing crop inputs for the following crop year. Most national crop loan rates were increased as part of the 2018 Farm Bill, and some groups are pushing for further increases in the commodity loan rates in the next Farm Bill. Land set aside and conservation programs were added to Farm Bills in the 1950’s, with the establishment of the “Soil Bank Program”. While the Soil Bank Program no longer exists, there have been many other set-aside and conservation programs, including the popular “Conservation Reserve Program” (CRP) that was added in the 1985 Farm Bill. The 2014 Farm Bill reduced the maximum CRP acreage from 32 million acres to 24 million acres, which was the lowest level since the initiation of the CRP program, which was gradually increased back to 27 million acres in the current Farm Bill. There are also several other conservation programs that are part of the current Farm Bill, including the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP), and the Agricultural Conservation Easement Program (ACEP). There are efforts by some members of Congress, as well as agricultural and environmental organizations, to have Farm Bill programs more directly linked with practices that enhance carbon sequestration efforts. Food stamps were added to Farm Bill in 1973, with the program being administered by USDA. Over 80 percent of the proposed funding for the next Farm Bill will go to SNAP related programs, which includes the food stamp program, the women, infants, and children (WIC) program, and the school lunch program. The Federal budget outlay for the SNAP program more than doubled from 2008 to 2013, then declined briefly before increasing again since 2020, due to the economic challenges caused by the COVID pandemic. Some members of Congress and other groups would like to see the Nutrition Title and SNAP programs removed from the Farm Bill. However, the Nutrition Title programs are important to nearly every member of Congress, including those in urban areas, which keeps all members engaged in Farm Bill discussions and the importance of food and agriculture. About 10-12 percent of the funding in the proposed Farm Bill will be targeted for farm commodity programs and crop insurance programs. The current Farm Bill provides eligible crop producers the choice between the county revenue based “Ag Risk Coverage” (ARC-CO) program, or the price-only “Price Loss Coverage” (PLC) program, for corn, soybeans, wheat, and other eligible commodity crops. The ARC-CO program is based on actual county crop yields and national average crop prices for a given crop year, compared to 5-year average benchmark yields and prices. The PLC program payments are based on national average crop prices for a given year compared to present crop reference prices. Some farm organizations are pushing for higher crop reference prices in the next Farm Bill, given the much higher crop input costs that have occurred in the past couple of years. The current Farm Bill does allow for small gradual increases in the crop reference prices during extended periods of higher commodity prices. The dairy margin protection program and sugar support programs are also included under the commodity title of the Farm Bill. Most crop producers and ag lenders will highlight a sound working crop insurance program as the “centerpiece” for a solid risk management plan in a farm operation. Over 95 percent of the corn and soybean acres in the Upper Midwest are typically insured by some type of crop insurance coverage. Most crop insurance premiums are subsidized at a rate of 60-65 percent by the federal government, as part of the Farm Bill. Some members of Congress and some organizations are calling for some changes and modifications to the current Federal Crop Insurance program, while most farm organizations are lobbying to keep the current program. Some livestock producer organizations would like to see enhancements to risk management programs for livestock production. Since the first Farm Bill in 1933, there have been 17 different Farm Bills in the past 90 years, with the next Farm Bill scheduled to be finished in the coming months. New Farm Bills are usually written about every five years, with the longest period between new Farm Bills being nine years from 1956 to 1965, and the shortest period being one year from 1948 to 1949. The “Agricultural Act of 1949”, which is also known as the “permanent farm legislation”, was never repealed or allowed to expire, and becomes the Farm Bill legislation for many commodity programs if a new Farm Bill is not enacted when the previous Farm Bill expires. Many provisions in the 1949 legislation are very outdated and did not include the SNAP program, the current crop insurance program, or many popular ag and conservation programs, including CRP. The existence of the fallback to the 1949 legislation gives Congress extra incentive to complete Farm Bills in a timely manner. The passage of a new Farm Bill is very complex, with programs ranging from farm commodity programs to food and nutrition programs, from conservation programs to rural development programs, and many more. In many cases, finalizing a Farm Bill in Congress can be quite controversial, and not necessarily by political party lines. The various Farm Bill programs become quite geographical, with members of Congress wanting to protect the farm, food and nutrition, conservation, and economic interests of their State or Congressional district. The very large federal budget deficit in recent years has added a new element to successfully passing a new Farm Bill. The last Farm Bill was written in 2018, to cover federal fiscal years from 2019-2023; however, Congress has been known to extend Farm Bills beyond the expiration date. Thus far, the discussion has been to have a new Farm Bill completed by the time the current Farm Bill expired on September 30, 2023, or shortly after. Ultimately, there will likely be a compromise reached, and a new 5-year Farm Bill will be passed sometime later this year, or more likely in 2024. Given the current political division that exists in Congress and the other legislative issues, it is appearing likely that a one-year extension of the current Farm Bill is quite possible. From a commodity program standpoint, this would likely extend the current farm program provisions for an additional year in 2024. |

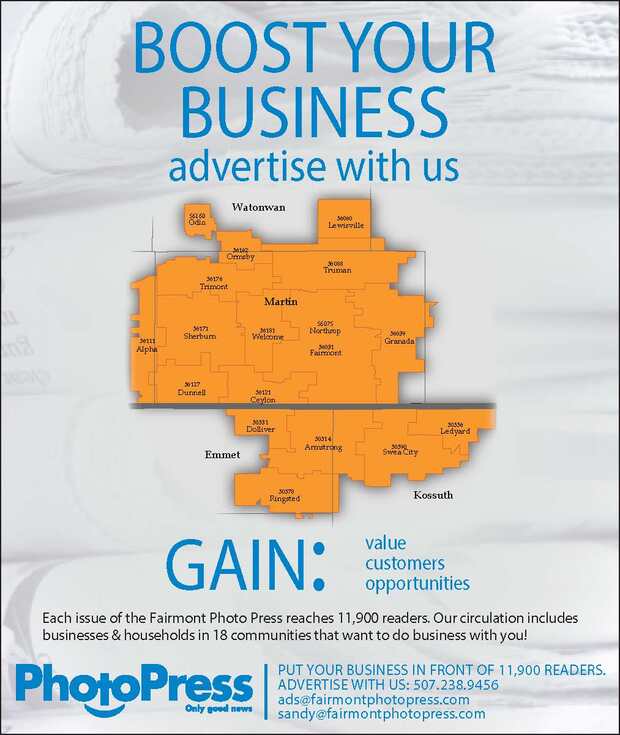

Contact Us:

Phone: 507.238.9456

e-mail: frontdesk@fairmontphotopress.com

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: frontdesk@fairmontphotopress.com

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed