AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

The University of Minnesota recently reported that the average net farm income for Southern Minnesota farmers in 2022 was $311,240, which was the highest average net farm income on record, surpassing the 2021 level of $280,900. The very positive net farm income levels from 2020-2022 followed seven years (2013-2019) in a row of sup-par net farm income levels in the region. The 2021 and 2022 net farm income levels in Southern and West Central Minnesota have been enhanced by robust crop profits that resulted from average to above average crop yields and the highest grain market prices since 2012. Livestock profit margins in 2022 in Southern Minnesota were mixed and typical livestock profit levels were at much more modest levels than the crop profits.

The Farm Business Management (FBM) Summary for Southern and West Central Minnesota is prepared by the Farm Business Management Instructors. This summary includes an analysis of the farm business records from farm businesses of all types and sizes in Southern and Western Minnesota. This annual farm business summary is probably one of the “best gauges” of the profitability and financial health of farm businesses in the region on an annual basis. Following are some of the key points from the data in the 2022 FBM Summary: BACKGROUND DATA · The “Net Farm Income” is the return to labor and management, after crop and livestock inventory adjustments, capital adjustments, depreciation, etc. have been accounted for. This is the amount that remains for family living, non-farm capital purchases, income tax payments, and for principal payments on farm real estate and term loans. The average net farm income in 2022 was +$311,240. · The “median” net farm income is the midpoint net farm income of all farm operations included in the FBM Summary, meaning that half of the farms have a higher net farm income and half have a lower net income. The average median net farm income in 2022 was +$177,614. · A total of 1,476 farms from throughout South Central, Southwest, Southeast, and West Central Minnesota were included in the 2022 FBM Summary. The average farm size was 683 acres. The top 20 percent net income farms averaged 1,667 acres, while the bottom 20 percent net income farms had 205 acres. · 63 percent of the farm operations were cash crop farms, 12 percent were single entity livestock operations, and the balance are various combinations of crop, livestock, and other enterprises. · 352 farms (24%) were under $250,000 in gross farm sales in 2022; 274 farms (18%) were between $250,000 and $500,000 in gross sales; 361 farms (25%) were between $500,000 and $1 million in gross sales; and 489 farms (33%) were above $1 million in gross sales. · In 2022, the average farm business received $14,606 in government program payments, which includes CRP and conservation payments. This was down considerably from 2021 when the average was $58,196 in government payments which included many one-time payments related to the Covid pandemic and 2019 crop disaster payments. In addition, the average farm operation received $7,792 in crop insurance payments in 2022, which was considerably lower than the level of crop insurance payments from 2018-2020. The combination of farm program payments and crop insurance payments accounted for approximately 4.7 percent of the 2022 average net farm income. This compares to 2020, when government payments and crop insurance payments totaled over $126,000 and made up about 74 percent of the average net farm income. · The average family living expense in 2022 was $71,375, which increased slightly compared to recent years. The average non-farm income in 2022 was $45,240, which represents about 38 percent of total annual non-farm expenses ($121,163) by families for family living and other uses. · In 2022, the average farm business spent $1,281,210 for farm business operating expenses, capital purchases, and non-farm expenses. Most of these dollars were spent in local communities across the region, helping support the area’s overall economy. FARM FINANCIAL ANALYSIS · The average net farm income for Southern and West Central Minnesota for 2022 was $311,240, while the median net farm income for the region was $177,614. This compares to median net farm income levels of $176,426 in 2021, $102,848 in 2020, $36,547 in 2019, and $20,655 in 2018. · As usual, there was large variation in median farm income in 2022, with top 20 percent profitability farms averaging a median net farm income of +$728,237, and the low 20 percent profitability farms with an average median net farm income of only +$13,238. · The variation in 2022 median net farm income also tracked very closely with the gross farm receipts of farms. Farms with $1 to $2 million in gross receipts had a median net farm income of +$433,787, compared to +$224,828 for farms with a gross of $500,000 to $1 million, +$125,428 for farms with a gross of $250,000 to $500,000, and +$56,528 for farms with a gross of $100,00 to $250,000. Interestingly, there was very little difference in the profit margin between the income groups. The $100,000 to $250,000 group was at 25.1% profit margin, the $250,000 to $500,000 group at 28.4% profit margin, the $500,000 to $1 million group at 27.4% profit margin, and the $1 to $2 million group at 27.6% profit margin. · The average farm business showed working capital of +$601,008 in 2022, which is three times higher than the average working capital three years ago in 2019. The current ratio (current assets divided by current expenses) for 2022 was 283%, which compares to 247% in 2022, 198% in 2020, and 156% in 2019. The working capital to gross revenue ratio for 2022 was 49.4%, which is more than double the level in 2018 and 2019. The working capital had declined to concerning levels for many farm operations prior to 2020, before showing significant improvement from 2020-2022. · Another measure of the “financial health” of a farm operation is the “term debt coverage ratio”, which measures the ability of farm operations to generate adequate net farm income to cover the principal and interest payments on existing real estate and term loans. If that ratio falls below 100%, it results in the farm business being required to use working capital or non-farm income sources to cover the difference. The average term debt coverage ratio for 2022 was at the healthy level of 372%, which compares to average ratios 389% in 2021, 274% in 2020, 148% in 2019, and 91% in 2018. However, the low 20 percent profitability farms had a term debt coverage ratio of only 85% in 2022. · Any additional cash flow dollars over and above the term debt principal and interest payments that are earned by farm operation are available for machinery replacement or other capital improvements. In 2022, the average farm had $224,856 available for those purposes, while high 20 percent profitability farms had $726,122 available. This helps explain the strong demand for new and used farm machinery, the planned grain system improvements, and other farm and non-farm upgrades that have occurred in recent months. BOTTOM LINE Overall, net returns from crop operations in 2022 were among the best ever; however, livestock profitability was much more modest. As usual, there was a wide variation in farm profit levels from the top one-third of net farm income operations as compared to other farms. The overall average financial health of many farm businesses has improved significantly during the period from 2020-2022, after declining for several years due to low profit levels. Farm profit levels were quite favorable in 2022; however, there are some “caution flags” on the horizon. These include rapidly increasing input expenses and land costs, potential declines in grain and livestock market prices, and lower levels of government payments. Complete farm business management results are available through the University of Minnesota Center for Farm Management FINBIN Program at: http://www.finbin.umn.edu/ Note - For additional information contact Kent Thiesse, Farm Management Analyst and Sr. Vice President, MinnStar Bank, Lake Crystal, MN. (Phone - (507) 381-7960) E-mail - [email protected]) Web Site - http://www.minnstarbank.com/

0 Comments

Read More

Back to Blog

The USDA World Agricultural Supply and Demand Estimates (WASDE) Report released on May 12 projected record production levels in 2023 and a likely increase in corn and soybean ending stocks by the end the 2022-23 marketing year on August 31, 2024. U.S. wheat stocks are expected to show in slight decrease in the coming year. From a grain marketing standpoint, the initial reaction to the WASDE report was widely regarded as somewhat “bearish” for corn and soybeans and mainly neutral for wheat. USDA is projecting that the national average grain prices for both corn and soybeans will decline by nearly $2.00 per bushel for the 2023-24 marketing year, compared to 2022-23 price levels. Following are some highlights of the latest USDA WASDE Report:

Corn: Based on the May 12 USDA WASDE Report, the projected corn ending stocks for the 2022-23 marketing year are estimated at 1.417 billion bushels, which is an increase of 75 million bushels from the April Report, due to an expected reduction in corn exports of 75 million bushels. The anticipated 2022-23 corn ending stocks are an increase from 1.377 billion bushels in 2021-22 and 1.235 billion bushels in 2020-21. USDA is projecting that total U.S. corn usage for 2022-2023 13.73 billion bushels for livestock feed, ethanol, exports, etc., which is a decrease of 1.23 billion bushels or almost 9 percent compared to the 2021-22 usage level. The much lower estimated corn usage was mainly due to a rather large decrease in the estimated amount of corn used for feed in 2022-23, as well as significantly lower corn export levels, compared to a year earlier. The 2022-23 corn stock-to-use ratio is now estimated at 10.3 percent, up from 9.2 percent in 2021-22; however, the ratio remains quite tight. The May WASDE Report also offered an initial USDA estimate for corn carryover levels in the 2023-24 marketing year, which ends on August 31, 2024. The corn ending stocks were estimated at 2.22 billion bushels, which would be an increase of 805 million bushels or 57 percent compared to the end of the 2022-23 marketing year. The 2023-24 stocks-to-use ratio is expected to increase to 15.3 percent. The projected 2023-24 ending stocks were well above the average grain-trade estimates and the carryout level would be the highest since the end of the 2016-17 marketing year. USDA is estimating the total corn supply for 2023-24 to increase by 1.56 billion bushels to just over 16.7 billion bushels, while the total corn usage for the year is only expected to increase by 755 million bushels to just over 14.48 billion bushels. USDA is forecasting increased corn usage for livestock feed and higher U.S. corn export levels in 2023-24, as well as a slight increase in usage for ethanol production. USDA is estimating total U.S. corn production in 2023 at the record level of 15.265 billion bushels, which would be an increase of approximately 11.2 percent from the total 2022 U.S. corn production. The USDA Report expects an estimated 92 million acres of corn to be planted in the U.S. in 2023, which compares to 88.6 million acres in 2022 and 93.3 million acres in 2021. USDA is projecting the average U.S. corn yield at 181.5 bushels per acre in 2023, which is up from the average yields of 173.3 bushels per acre in 2022 and 176.7 bushels per acre in 2021. The WASDE corn yield estimate is very close to the trendline corn yield forecast at the USDA Ag Outlook Conference in February this year. Corn planting progress in 2023 has been running ahead of normal in many areas of the central and southern Corn Belt of the U.S. but is behind normal in some areas of the northern Corn Belt. As of May 12, USDA is estimating the average U.S “on-farm” corn price for the 2022-23 marketing at $6.60 per bushel, which was the same as the April estimate. The current USDA projected corn price compares to recent final national average prices of $6.00 per bushel for 2021-22, $4.53 per bushel for 2020-21, and $3.56 per bushel for 2019-20. USDA also released the first estimated average corn price for the 2023-24 marketing year at $4.80 per bushel, which would be $1.80 per bushel lower than the estimated 2022-23 average price and $1.20 per bushel below the final 2021-22 national average price. Soybeans: According to the May 12 WASDE Report, the projected soybean ending stocks for 2022-23 are estimated at 215 million bushels, which is up by 5 million bushels from the April estimate and was very close to the average grain trade estimates. The projected 2022-23 U.S. soybean ending stocks remain very tight and compare to other recent soybean carryover levels of 274 million bushels in 2021-22, 257 million bushels in 2020-21, 525 million bushels in 2019-20, and a whopping 909 million bushels in 2018-19. Total soybean usage for 2022-23 is estimated to be just over 4.35 billion bushels, which is down slightly from the total usage of 4.465 billion bushels in 2021-22. Soybean export levels for 2022-23 are projected to decrease slightly compared to a year earlier; however, soybean sales to China have remained strong. USDA projected a slight increase in bushels used for soybean processing in the U.S for 2022-23 compared to crush levels a year earlier. Some analysts feel that domestic soybean demand may increase in the next few years with several new or expanded soybean processing plants scheduled to come on board, focusing on the production of renewable diesel. The May WASDE Report projects soybean ending stocks to increase by 120 million bushels to 335 million bushels by the end of the 2023-24 marketing year on August 31, 2024. USDA is estimating the total U.S. soybean supply to increase by 175 million bushels in 2023-24; however, the total soybean usage is only expected to increase by 56 million bushels compared to levels for 2022-23. The projected ending soybean stocks-to-use ratio for 2023-24 is estimated at 7.6 percent, which compares to 4.9 percent in 2022-23 and 6.1 percent in 2021-22. Total U.S. soybean production in 2023 is estimated at the record level of 4.51 billion bushels, which would be an increase from the estimated U.S. soybean production of 4.276 billion bushels in 2022 and just over 4.46 billion bushels in 2021. Interestingly, a year ago in May USDA projected the 2022 U.S. soybean production at 4.64 billion bushels and the actual 2022 production was 364 million bushels less. Planted soybean acres for 2023 are projected at 87.5 million acres, which is the same as 2022 and just above 2021 soybean acreage. USDA is estimating a national average soybean yield of 52 bushels per acre in 2023, which compares to 49.5 bushels per acre in 2022 and 51.7 bushels per acre in 2021. The record U.S. soybean yield was 52.1 bushels per acre in 2016. USDA is estimating the U.S “on-farm” soybean average price at $12.10 per bushel for the 2023-24 marketing year, which runs from September 1, 2023 to August 31, 2024. The preliminary price estimate for the 2023-24 marketing year on May 1 would be a decline of $2.10 per bushel from the 2022-23 average price and $1.20 per bushel below the final 2021-22 average price. The projected final market year average price for 2022-23 is $14.20 per bushel soybean price, which compares to final average soybean prices of $13.30 per bushel for 2021-22, $10.80 per bushel for 2020-21, $8.57 per bushel for 2019-20, and $8.48 per bushel in 2018-19. Average soybean prices for 2023-24 will likely be highly dependent on 2023 soybean production in the U.S., as well as increases in soybean crush levels and the amount of U.S. soybean exports to China and other countries. Wheat: The May 12 WASDE Report projected U.S. wheat ending stocks to decline to 556 million bushels by the end of the 2023-24 marketing year on May 31, 2023. This compares to estimated ending stocks of 598 million bushels for 2022-23 and 698 million bushels in 2021-22. Wheat demand in 2023-24 is projected to decrease slightly from the current year demand, down to 1.837 million bushels, with the decline mainly due to lower export estimates. Wheat acreage in 2023 is expected to increase to 49.9 million acres and total U.S. wheat production is expected to increase slightly in 2023 to 1.66 billion bushels. Wheat acreage and production numbers could be adjusted downward in coming months, due to planting delays in the primary spring wheat production region. USDA is projecting the average “on-farm” wheat price at $8.85 per bushel for 2022-23 and $8.00 per bushel for 2023-24, which compares to final national average price of $7.63 per bushel in 2021-22 and $5.05 per bushel in 2020-21. |

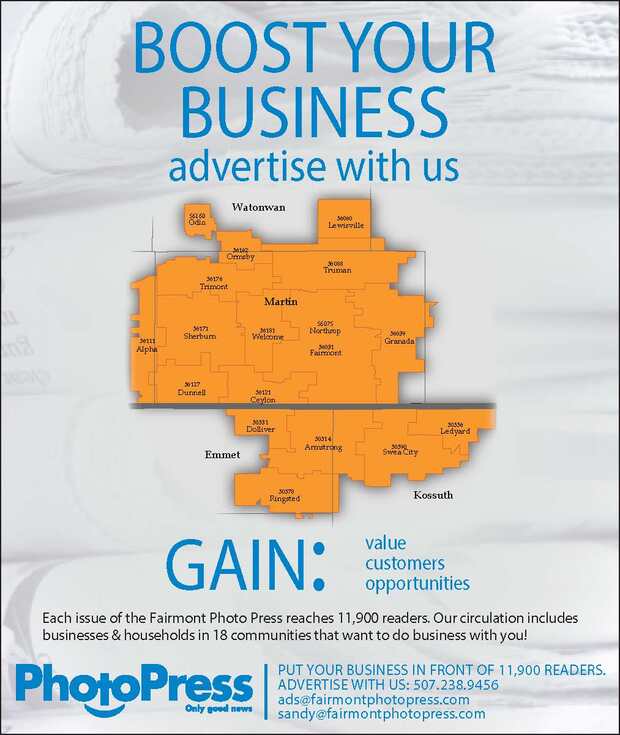

Contact Us:

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed