AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

Many farm operators provide some type of custom work or use of farm machinery to other farmers during the growing season, and payment is usually made following the completion of the harvest season. Sometimes, it can be difficult to arrive a fair custom rate for the certain farming practices, or for the use of various pieces of machinery. This could be the case in a year such as 2022, when the cost of machinery operation for diesel fuel, repairs, and labor have increased substantially from the beginning of the year until year-end.

Due to the high cost of investment in farm machinery, an ever-increasing number of farm operators are hiring other farm operators to provide some or all of the needed machinery resources for their farm operation. This is especially true with new and younger farm operators, as well as with children that decide to start farming with their parents. In addition, some land investors are choosing to operate a farm themselves rather than cash renting the land another farm operator, and thus they are hiring a farm operator under a custom farming agreement. One of the best resources for average custom rates is the annual “Iowa Farm Custom Rate Survey” that is coordinated and analyzed by Iowa State University. Each year in January, custom operators and farm managers are sampled regarding the expected farm custom rates for various farm operations. The custom rate summary, which is usually released in late February, lists the average custom rate, as well as a range in custom rates, for various tillage, planting, fertilizer and chemical application, grain harvesting, and forage harvesting functions on the farm. The Iowa Custom Rate Survey, which also includes many miscellaneous farming practices and a formula for calculating rental rates. is probably the most widely used custom rate information that is available in the Upper Midwest. The complete 2022 “Iowa Farm Custom Rate Survey” for all farming practices is available on-line at the following Iowa State University web site: https://www.extension.iastate.edu/agdm/crops/html/a3-10.html The average custom rates for farm operations in most areas of the Upper Midwest tend to be very close to the average Iowa custom rates. All listed custom rates in the Iowa survey results include fuel and labor, unless listed as rental rates or otherwise specified. These average rates are only meant to be a guide for custom rates, as actual custom rates charged may vary depending on increases in fuel costs, availability of custom operators, timeliness, field size, etc. In a year such as 2022 that has featured significant increases in operation costs for farm machinery, it may be justified and necessary to adjust some of those custom rates above the median or average rates. Based on the Iowa State data, average custom rates for tillage, planting, and harvest operations in 2022 were expected to increase by about 7 percent, compared to the rates for similar operations in 2021. The cost for new and used machinery increased rapidly in the past 12 months, which together with increasing fuel costs and higher labor charges, accounts for the increases in 2022 custom rates. It should be noted that many of these factors have continued to increase during 2022, which may result in custom operators increasing their final custom rates to even higher levels by year-end to fully cover the increasing expenses for custom operations. Good communications between the custom operators and farmer are very important in finalizing custom rates. All listed custom rates in the Iowa Survey results include fuel, labor, repairs, depreciation, insurance, and interest, unless listed as rental rates or otherwise specified. The average price for diesel fuel in the survey was assumed to be $3.33 per gallon; however current prices for diesel fuel are considerably higher than that price. A fuel price increase of $.50 per gallon would cause most custom rates to increase by approximately five percent. These average rates are only meant to be a guide for custom rates, as actual custom rates charged may vary depending on continued increase in fuel costs, availability of custom operators, timeliness, field size, etc. and could be adjusted later in the year due to changes in economic factors. Custom Farming Agreements Some farm operators hire custom work for specific farm operations with another farm operator, such as planting or combining, while other operators hire the typical crop field work through a custom farming agreement. The Iowa State Custom Rate Survey includes the average custom farming rates for corn, soybeans, and small grain. Custom farming agreements usually include tillage, planting, some weed control, harvesting, and delivering grain to a specified location. Usually, any other additional or necessary farm practices that are performed during the year are paid outside of the custom farming agreement. Many farm operators negotiate these types of custom farming arrangements in the Spring of the year, while others wait until harvest is completed. Although the concept of a custom farming agreement seems simple, close communication between the custom operator and the landowner is essential to a solid plan. It is recommended that a custom farming agreement include a written contract that specifies the typical cropping practices to be performed and the amount of payment per acre to be paid to the custom operator by the landowner, and all other pertinent details for the custom farming arrangement. The custom farming rates for corn and soybean production were expected to increase by about 1.5 percent compared to a year earlier; however, similar to the other custom rates, larger increases may be justified to cover increased costs of fuel, labor, etc. For more details on custom farming agreements, please refer to the Iowa State University “Ag Decision Maker” Web Site at: http://www.extension.iastate.edu/agdm/ Calculating Farm Machinery Costs The University of Minnesota periodically releases a publication titled: “Machinery Cost Estimates”, which was last updated in April of 2022. This summary looks at the use-related (operating) cost of farm machinery, as well as the overhead (ownership) costs of the machinery. The use-related expenses include fuel, repairs and maintenance, labor, and depreciation. Overhead costs include interest, insurance, and housing, which are calculated based on pre-set formulas. This publication can help serve as a good guide to help farm operators estimate their “true cost” of farm machinery ownership. The U of M machinery cost publication and other resources available on the costs of farm machinery ownership are available at: https://wlazarus.cfans.umn.edu/william-f-lazarus-farm-machinery-management. Another good resource for estimating the costs of farm machinery ownership is a publication from Iowa State University titled: “Estimating Farm Machinery Costs”, which includes a worksheet to calculate farm machinery costs. This publication is available at: https://www.extension.iastate.edu/agdm/crops/pdf/a3-29.pdf Check Grain Bins Most corn and soybean producers across the Midwest completed the 2022 harvest season quite early and may now need to pay close attention to grain that is stored in on-farm grain bins for potential storage problems. Due to deferred grain sales and the potential for higher corn and soybean prices in the coming months, a large amount of corn and soybeans is likely being stored on the farm following harvest in 2022. Most of the crop was placed into grain bins at a variety of outside temperatures, some grain at fairly warm temperatures and other grain at much cooler temperatures. This grain temperature difference, along with fluctuations in recent outside temperatures, can result in wide temperature variations in the final grain temperature within grain bins. This can lead to moisture migration in the bin, which could potentially result in significant grain spoilage if the situation is not properly addressed. There have already been reports of grain going out of condition in some areas. Farm operators should run aeration fans periodically to equalize the grain bin temperatures, which will help prevent this situation from occurring. It is also very important to check grain bins on a regular basis for any potential storage issues, and to address those issues promptly. Otherwise, there can be considerable damage to grain that is in storage, which can result in a significant financial loss to the farm operator.

0 Comments

Read More

Back to Blog

MINOR CHANGES IN NOVEMBER USDA REPORTS11/16/2022 The monthly USDA World Supply and Demand Estimates (WASDE) Report was released on November 9, which may have some impact corn and soybean markets in the coming months. The WASDE Report made minor adjustments to projected 2022-23 U.S. corn and soybean carryover estimates at the end of the current marketing year on August 31, 2023, as compared to estimates last month. The biggest surprise to the grain markets was a slight increase in the estimated corn and soybean production levels for 2022 compared to a month earlier, which resulted in slightly higher carryout levels for both corn and soybeans in the November WASDE Report.

Most grain marketing analysts viewed the latest USDA reports as somewhat “bullish” for future corn prices and “neutral” for soybean prices. December corn futures closed at $6.64 per bushel on the Chicago Board of Trade (CBOT) following the November 9 report, which compares to a price of $6.96 per bushel following the WASDE report on September 12 and to $5.55 per bushel following the November WASDE report in 2021. CBOT November soybean futures closed at $14.52 per bushel following the latest WASDE report, which was below the $14.88 per bushel price following the September report and compares to $11.38 per bushel following the WASDE report in November of 2021. The 2022 national average corn yield is now estimated at the record level of 172.3 bushels per acre, which was increased from 171.9 in October. The 2022 harvested corn acreage in the U.S. was maintained 80.8 million acres, resulting in a total estimated 2022 corn production of 13.93 billion bushels. This compares to total U.S. corn production levels of near 15.1 billion bushels in 2021, 14.1 billion bushels in 2020 and to 13.6 billion bushels in 2019. Total corn usage for the 2022-23 year is now estimated at just over 14.175 billion bushels, which would be down from 14.956 billion bushels in the 2021-22 marketing year. Corn export levels and the amount of corn used for both feed and ethanol production during the current marketing year, which ends on August 31, 2023, were all reduced from corn usage levels during the 2021-22 marketing year. USDA is now estimating 2022-2022 U.S. corn ending stocks at 1.182 billion bushels, which was 10 million bushels above the October estimate. This compares to carryout levels of 1.338 billion bushels in 2021-22, 1.24 billion bushels in 2020-21, and 1.99 billion bushels for 2019-20. Based on current estimates, the U.S. corn carryout to use ratio would be at 8.3 percent for 2022-23, which compares to 9.2 percent for 2021-22, 8.3 percent in 2020-21, and 14.4 percent in 2019-20. The continued tighter corn stocks could result in the potential for some short-term rallies in the cash corn market and continued tight basis levels at many locations in the coming months. The 2022-23 U.S. soybean ending stocks in the recent WASDE Report were estimated at 220 million bushels, which was an increase of 20 million bushels compared to the October USDA report. The projected soybean ending stocks compare to 274 million bushels in 2021-22 and 256 million bushels in 2020-21; however, the projected 2022-23 carryout level is well below the ending stocks of 523 million bushels in 2019-20 and 913 million bushels in 2018-19. The soybean stocks-to-use ratio for 2022-23 is estimated at 5 percent, which is down from down from 6.1 percent on 2021-22 and well below levels of 11.5 percent in 2019-20 and 23 percent for 2018-19. Total U.S. soybean production for 2022 was estimated at just under 4.346 billion bushels in the November report, which was increased by 33 million bushels from the October estimate and was slightly higher than the average grain trade projection. Total soybean demand for 2022-23 is projected at 4.414 billion bushels, which is down slightly from 4.465 billion bushels in 2021-22. The anticipated reduction in U.S. soybean demand in the coming year is primarily due to a decrease in the expected soybean export levels in 2022-23. The fact that soybean ending stocks remain fairly tight may offer some opportunities for short-term rallies for farm-level soybean prices in the coming months, especially if there are any weather-related production issues in South America. Based on the November WASDE report, USDA is currently estimating the U.S average on-farm cash corn price for the 2022-2023 marketing year at $6.80 per bushel, which was unchanged from the October report. The USDA price estimates are the expected average farm-level prices for the 2022 crop year from September 1, 2022, to August 31, 2023; however, they do not represent estimated prices for either the 2022 or 2023 calendar year. The projected USDA average corn price of $6.80 per bushel would be the highest since 2012-13 following the 2012 drought. The 2022-23 estimated corn price compares to recent national average corn prices of $6.00 per bushel for 2021-22, $4.53 per bushel for 2020-21, $3.56 per bushel for 2019-20, and $3.61 per bushel for 2018-19. USDA maintained the projected U.S. average farm-level soybean price for the 2022-2023 marketing year at $14.00 per bushel, which was also the same as the October estimate. The projected national average soybean price would be the highest in the past decade. The 2022-23 projected national average soybean price compares to prices $13.30 per bushel in 2021-22, $10.80 per bushel for 2020-21, $8.57 per bushel for 2019-20, $8.48 per bushel for 2018-19, and $9.35 per bushel for 2017-18. USDA 2022 Corn and Soybean Yield Projections Below 2021 Yields Based on the USDA Crop Production Report released on November 9, the projected U.S. average corn yield for 2022 will be 172.3 bushels per acre which was a decrease from the record U.S. corn yield of 177 bushels per acre in 2021. This compares to other recent U.S. corn yields of 171.4 bushels per acre in 2020, 167.5 bushels per acre in 2019, and 176.4 bushels per acre in 2018. The projected 2022 U.S. harvested corn acreage is 80.8 million acres is a decrease of 5.3 percent from 85.3 million acres that were harvested last year. The November USDA Report increased the projected 2022 corn yields from the October report in Illinois by 5 bushels per acre, Indiana by 4 bushels, Iowa and North Dakota by 2 bushels per acre, and Minnesota by 1 bushel per acre. The latest USDA report left the projected corn yield unchanged from a month earlier in Wisconsin, while reducing estimated yield levels in Nebraska and South Dakota by 4 and 5 bushel per acre respectively. Minnesota is now projected to have a statewide average corn yield of 191 bushels per acre in 2022 compared to 177 bushels per acre in 2021, with Iowa are at 202 bushels per acre in 2022 compared to 204 bushels per acre in 2021. Other projected 2022 State average corn yields are Illinois at 215 bushels per acre, Indiana at 191 bushels per acre, Ohio at 186 bushels per acre, North Dakota at 143 bushels per acre, and Wisconsin at 182 bushels per acre. The drought-stricken States of Nebraska and South Dakota are projected at 168 and 125 bushels per acre respectively. USDA is estimating the 2022 U.S. soybean yield at 50.2 bushels per acre, which is an increase of 0.4 bushels from the October estimate. The projected 2022 national average soybean yield compares to 51.7 bushels per acre in 2021, 51 bushels per acre in 2020, 47.4 bushels per acre in 2019, 50.6 bushels per acre in 2018, the record U.S. soybean yield of 52.0 bushels per acre in 2016. The 2022 harvested soybean acreage is projected at 86.6 million acres, which up slightly from the 2021 U.S. soybean acreage of 86.3 million acres; however, the 2022 acreage is well above the U.S. soybean harvested acreage of 82.6 million acres in 2020 and 74.9 million acres in 2019. USDA is estimating the 2022 Minnesota soybean yield at 50 bushels per acre, which is up from 47 bushels per acre in 2021, while Iowa is projected at 59 bushels per acre in 2022, compared to a record 63 bushels per acre in 2021. Other States with strong soybean yields for 2022 include Illinois at 64 bushels per acre, Indiana at 59 bushels per acre, Ohio at 55 bushels per acre, Wisconsin at 54 bushels per acre, and North Dakota at 36 bushels per acre. The 2022 statewide yield estimate in drought-stricken Nebraska is projected at 50 bushels per acre, which compares to 63 bushels per acre in 2021, while the South Dakota yield is estimated at 39 bushels per acre in 2022, compared to 40 bushels per acre in 2021.

Back to Blog

On any given day, farm operators and others can get grain price quotes from the CME Group, also known as the Chicago Board of Trade (CBOT), in “real-time” on their computer or I-phone. Almost as quickly, they can get current and future corn and soybean market price quotes from local grain elevators, ethanol plants, and processing plants. The difference between the local grain price and the CBOT price is known as “basis”. Understanding how basis works and the seasonal trends associated with basis can be an important factor in making corn and soybean marketing decisions.

More specifically, “basis” is the difference between the local grain price quote on a specific date and the CBOT price for the corresponding futures contract month. Local harvest price quotes for corn and soybeans would typically correspond to the December CBOT corn futures price and the November CBOT soybean futures price. By comparison, storing the corn or soybeans after harvest and selling the grain via a forward contract in June or early July the following Summer would have the basis level correspond to the July CBOT corn or soybean futures. A “narrow” or “tighter” basis means that the local corn or soybean price is getting closer or above the corresponding CBOT price, while a “wide” or “widening” basis reflects local grain prices that have a greater margin below the CBOT prices. In many years up until recently, farmers in the Upper Midwest dealt with “negative” basis levels, which means than local corn and soybean prices are lower than the corresponding CBOT prices. Areas near the Mississippi River ports or in the Southern U.S more typically have “positive” basis levels, where local grain prices are higher than CBOT prices. However, there have been several areas of the Upper Midwest that have had “positive” basis levels for corn and soybeans at certain times during 2021 and 2022. While the definition of “basis” may seem quite simple, the dynamics of understanding basis can be quite complex. Basis is variable at different locations and can vary throughout the year, or suddenly be adjusted due to changing dynamics in grain market fundamentals. Following are the main factors that affect basis and can lead to changes in basis levels:

There is currently a wide range in harvest-time corn basis levels the Midwest, depending on 2022 corn yields and demand for corn usage. For example, in portions on Nebraska and Kansas that were impacted by the drought in 2022, the early November corn basis level is +$.50 to +$1.50 above the nearby CBOT December corn futures price, which is a much different pattern than normal. By comparison, corn basis levels in areas of Southern Illinois are ($.50) to ($1.00) per bushel below December CBOT price, which is a much wider basis level than normal, resulting from reduced barge traffic on the lower Mississippi River due to low water levels. The national average corn basis level on November 3 was +$.05 per bushel above the CBOT December futures price. The corn basis level on November 3 in Southern Minnesota ranged from about ($.25) per bushel under the CBOT December futures price to +$.15 above the CBOT price. Soybean basis levels in Southern Minnesota on November 3 generally ranged from ($.15) under to +$.05 over the CBOT January futures price, with some soybean processing plants as high as +$.40 above the futures price. In the six years (2015-2020) prior to 2021, early November corn basis levels in Southern Minnesota had typically averaged ($.35) to ($.45) per bushel below the nearby CBOT futures price and soybean basis levels were ($.40) to ($.90) per bushel under futures prices. Currently, many farmers are quite “bullish” about grain market prices in 2023, meaning that they feel there is a good chance of corn and soybean prices rising in the coming months. The current basis levels for both crops in many areas are encouraging producers to sell their grain in the next few months, rather than waiting until next Summer to market the grain. Corn futures and cash prices are currently projected to stay fairly steady from now until July of 2023, meaning there is very little difference in the expected basis levels by next Summer. At soybean processing plants in Southern Minnesota, the soybean basis was +$.40 per bushel on November 3, compared to minus ($.15) per bushel in July of 2023, so even though the CBOT futures price for July is $.16 per bushel higher than the January price, the cash soybean bid for July is ($.39) per bushel lower than the current cash bid. There are several grain marketing tools available for farmers to utilize besides cash sales, including a variety of hedging, options and basis contracts, Typical hedging or options contracts lock in the CBOT futures price but not the cash price, meaning that there is still basis risk. For example, a “hedge-to-arrive” contract locks in a CBOT futures price but the basis is not finalized until the futures contract is cleared and the grain is sold. By comparison, a basis contract locks in the basis but keeps the final price open depending on changes in the corresponding CBOT futures price and actual cash price at the time of delivery. Depending on an individual’s willingness to assume some market risk, they could also sell the grain for cash to realize the advantage of the current basis levels and take a CBOT options or futures price position to keep some upside potential in the corn and soybean markets. Most grain marketing strategies, including storing unpriced grain in a bin on the farm, involve some level of price and/or basis risk. Understanding the dynamics of basis in corn and soybean market prices is a key element in analyzing the various types of grain marketing contracts that are available to farm operators. Iowa State University has some good information available on understanding basis and various grain marketing strategies. This information is available on the “Ag Decision Maker” website at: https://www.extension.iastate.edu/agdm

Back to Blog

As the 2022 harvest season is rapidly drawing to a close, many areas of the Corn Belt are now in a moderate to severe drought, with conditions worsening in the past couple of months. The latest “U.S. Drought Monitor” released on October 27 places all of Iowa, Nebraska, South Dakota, Indiana, Kansas, and Missouri at some level of drought, as well as much of the major crop producing areas of Minnesota, Illinois and North Dakota. Currently, approximately 60 percent of the tillable crop acres in the U.S. are being impacted by some level of drought. The National Drought Mitigation Center, which produces the updated U.S. Drought Monitor on a weekly basis, indicated that current conditions are comparable to the Fall of 2012, when over 61 percent of the U.S. crop acres were impacted by some level of drought.

According to the latest U.S. Drought Monitor, nearly all of Nebraska, Kansas, Oklahoma, and North Texas is now categorized to be in either the extreme drought (D3) or severe drought (D2) category, with a growing portion of that region in an exceptional drought (D4) category. There is a growing area of worsening drought in the Ohio River Valley and Southern Mississippi River basin area. Nearly the entire western two-thirds of the United States is listed in some level of drought at the end of October. Some Western States and Great Plains States have been dealing with drought conditions for two to three years. Areas that are in the extreme (D3) or exceptional (D4) drought areas are more likely to incur significant crop loss and have extremely limited forage production. Based on the U.S. Drought Monitor for Minnesota on October 27, all areas of the State except the Arrowhead region and a small portion of North Central and Northwest Minnesota were categorized in some level of drought. Nearly the entire Southern half of the State was in the “moderate” to “severe” drought category, with a small portion of Southwest Minnesota and a larger area just west and south of the Twin Cities metro area in an “extreme” drought category. Back in mid-Summer of 2022, very few areas were listed in any type of drought category. Sometimes the “Drought Monitor” is somewhat misunderstood. It is meant to measure the overall long-term impacts of extended drought conditions, as compared to representing current crop conditions. This is why some areas that are listed in “moderate” or “severe” drought may still have had fairly good crop yields in 2022, even with below average rainfall, depending on the timeliness of the rainfall events during the growing season. Some portions of the Upper Midwest also benefitted from starting the 2022 growing season with average to above average levels of stored soil moisture, which has also helped maintain crop development through some very dry periods during the Summer months. The continued drought across the region is certainly a concern as we look forward to the 2023 growing season, with stored soil moisture levels across the Midwest at historically low levels in many locations. The post-harvest stored moisture levels at many reporting stations ranges from near zero to only a few inches in the top five feet of soil, compared to normal levels of six to seven inches of stored soil moisture in late October. Nearly 75 percent of the primary growing areas in the U.S. for winter wheat are in moderate, severe or extreme drought conditions, which is at the highest level in over twenty years. Winter wheat is seeded in the Fall and harvested the following Summer. Dry soil conditions in the Fall can result in poor germination and stunt the early growth of the winter wheat, which can result in yield reductions the following year. The intense drought conditions in some corn and soybean production areas can also lead to challenges with Fall fertilizer and manure applications, as well as making Fall tillage more difficult. Nitrogen fertilizer costs nearly three times as much as it did two years ago, so farmers need to carefully consider Fall soil conditions if they plan to apply anhydrous ammonia this Fall. Producers may also want to limit their Fall tillage or consider the use of cover crops to reduce the potential for wind erosion during the Winter months. According to precipitation data at the University of Minnesota Southwest Research Center at Lamberton, drought-like conditions have existed for the past 2-3 months. From June 1 to October 28, 2022, the Lamberton location had received only 6.57 inches of precipitation, which is 9.73 inches less than average, and represents only 40 percent of the normal rainfall amount during the Summer and Fall months in 2022. By comparison, the U of M Research Center at Waseca in South Central Minnesota received close to normal precipitation in June, July and August but has become quite dry in September and October. Waseca has received only 1.08 inches of precipitation in September and October, while Lamberton has received only .93 inches. Other two-month precipitation totals for September and October from the National Weather Service, included Wheaton at .47 inches and Windom at .62 inches, which were both the driest ever recorded, and New Ulm at .60 inches, the third driest in history. The warm, dry weather during late September and October has allowed the Fall harvest season to progress quite rapidly in most areas of the Upper Midwest. By the end of October, soybean harvest had been completed and corn harvest was about 80-90 percent completed across southern Minnesota. Overall, the “whole-field” corn and soybean yields across the Midwest were highly variable, even in the same county or township, depending on the amount and timeliness of rainfall events during the growing season. Some areas of Southern Minnesota and North Central Iowa had some of their best corn and soybean yields ever, while farmers in Nebraska, Western Iowa and portions of Southern south Dakota had greatly reduced crop yields due to the drought impacts in 2022. The good news for all producers regarding the 2022 corn harvest has been the low harvest moisture of the corn coming out of the field, and the high quality of the corn. Most of the corn being harvested in Southern Minnesota in the past few weeks has been at 15-18 percent moisture, meaning it can go directly to farm grain bins with very little or no additional drying, or can be hauled to grain purchasers with very little price dockage for excess kernel moisture. The rapid field dry down of the corn is saving most producers $30.00-$35.00 per acre in anticipated corn drying costs. Most of the corn being harvested in Southern Minnesota has had a test weight that is at or above the standard test weight for corn of 56 pounds per bushel, which also adds value to the corn. The fire danger throughout in many areas remains extremely high due to the very dry conditions and frequent windy days. These conditions can quickly ignite field and grass fires that can cause significant damage. Farm operators need to use extra caution with farm machinery, grain trucks and other vehicles in the very dry fields. They also need to make sure that fire extinguishers are working properly and take other necessary fire safety precautions. The general public must also take care not to accidentally ignite a fire near farm fields, or in other rural areas. The ongoing drought conditions in many regions are also highly visible with the extremely low levels of lakes, rivers, and streams. In some instances, areas that have suffered intense drought levels for two or three years could also be impacted by reduced ground water levels. Based on the weather data in Southern Minnesota, the Fall precipitation pattern in 2022 is very similar to the pattern in the fall of 2011. Of course, the Fall of 2011 was followed by the major drought in the Summer of 2012, which was quite intense in many areas of the Midwest and across the U.S. The Summer of 2012 was driest since 1988, another major drought year, and was the second hottest Summer on record, trailing only 1936. The 2012 drought caused nearly $30 billion in agricultural losses, resulting in a loss of approximately 25 percent of the U.S. corn and sorghum crops, as well as major impacts on hay and pasture production and large financial losses to U.S. beef producers. On the other hand, both 1976 and 1952 also had very dry conditions in the Fall in the Midwest; however, both years were followed by above normal precipitation and fairly good crop production in the following year. So, there is no certainty when it comes to predicting long-term weather patterns based on current conditions but there is certainly cause for some concern as we look ahead to the 2023 growing season. |

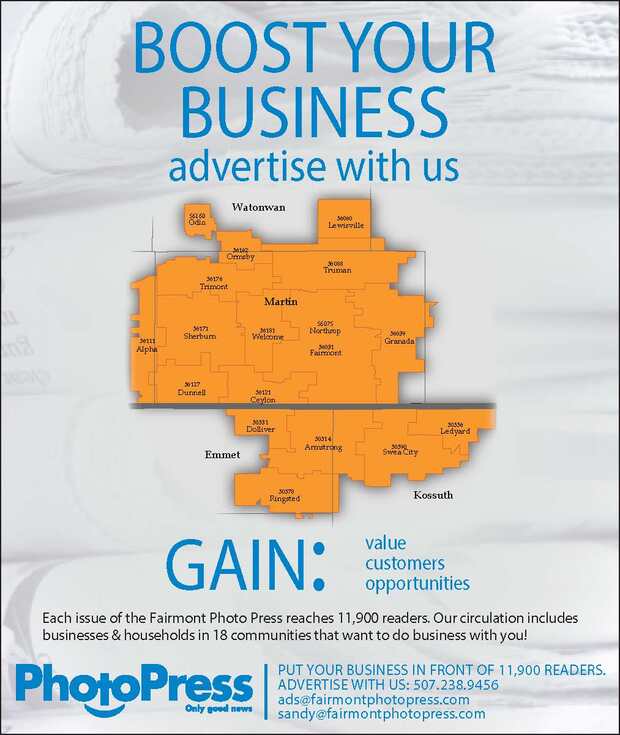

Contact Us:

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed