AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

2022 CROP INSURANCE PAYMENT POTENTIAL10/26/2022 Crop producers in Nebraska, South Dakota, Western Iowa, portions of Minnesota, and other States that were impacted by lack of rainfall and varying degrees of drought conditions during the 2022 growing season may have final corn and soybean yields that are well below their APH crop yields. Other areas of the Upper Midwest may have also been impacted by severe storms that caused some yield reductions. Farmers in any of these areas could potentially realize some 2022 crop insurance indemnity payments, due to the reduced yields this year. A yield reduction well below APH yields will be necessary in order to receive any 2022 crop insurance payment for corn, due to the final corn harvest price likely to be higher than the Spring base price. This situation for soybeans will be somewhat different the harvest price will be below the Spring base price.

The Federal crop insurance harvest prices for corn and soybeans are based on the average Chicago Board of Trade (CBOT) price for December corn futures and November soybean futures, during the month of October, with the harvest prices being finalized by the USDA Risk Management Agency (RMA) on November 1. The Spring base prices for corn and soybeans are based on the average CBOT prices for December corn futures and November soybean futures during the month of February. The final harvest prices will be used to calculate the value of the 2022 harvested crops for all revenue protection (RP) crop insurance policies, as well as to potentially determine the revenue guarantee for the RP policies that include harvest price protection if the harvest price is higher than the base price; otherwise, the base price will be used to determine revenue guarantees for RP policies. The harvest price for corn will be higher than the base price for corn RP policies in 2022, so the harvest price will be used for crop insurance guarantee calculations on RP policies this year. The Spring base price for corn will use for 2022 guarantee calculations for all yield protection policies (YP) and revenue protection with harvest price protection (RPE). The situation will be different for soybeans, with the harvest price being lower than the base price and the base price being used for all RP calculations in 2022. Farm operators with final corn yields that are within 15 percent of their 2022 crop insurance actual production history (APH) crop yields will likely not receive any crop insurance indemnity payments; however, that situation will be different for soybeans. The estimated 2022 harvest prices as of 10-24-22 were $6.79 per bushel for corn, compared to a base (Spring) price of $5.90 per bushel, and $13.79 per bushel for soybeans, compared to a base price of $14.33 per bushel. The base price will be used to calculate and crop insurance indemnity payments on farms insured by yield only YP policies and on RPE policies for both corn and soybeans, as well as on RP policies for soybeans in 2022. The harvest price will be used to determine the revenue guarantee for all corn RP policies, but not on RPE policies that include the harvest price exclusion. The harvest price will also be used to calculate the final revenue amount for all RP and RPE policies for both corn and soybeans. Optional Units versus Enterprise Units Farm operators in areas with variable yield losses on different farm units that chose “optional units” for their 2022 crop insurance coverage rather than “enterprise units” may be in a more favorable position to collect potential indemnity payments on this year’s crop losses. “Enterprise units” combine all acres of a crop in a given county into one crop insurance unit, as compared to “optional units”, which allow producers to insure crops separately in each township section. In recent years, a high percentage of crop producers have opted for “enterprise units”, due to substantially lower crop insurance premium levels. Crop losses in many areas in 2022 were highly variable from farm-to-farm within the same county and township, which would favor the “optional units” for collecting crop insurance indemnity payments this year. RP Crop Insurance Calculations for Corn and Soybeans in 2022 The 2022 crop insurance calculations for RP insurance policies with harvest price protection will likely function differently for corn and soybeans. Here are the details for 2022 RP calculations:

The Type of Insurance Coverage will affect Potential Corn Indemnity Payments The level of crop insurance coverage and having RP insurance policies, with harvest price protection, can be a big factor in determining the amount of insurance indemnity payment that is received for crop yield reductions. Most corn and soybean producers in the Upper Midwest are carrying 75%, 80%, or 85% RP insurance coverage in 2022; however, there are some producers that utilized YP (yield only) or RPE (harvest price exclusion) policies in order to reduce crop insurance premiums. There could be a big difference in the potential final results of the various insurance policies for corn in 2022, due to the type of insurance policy, the level of insurance coverage, and the impact of the harvest price. To receive a copy of an information sheet and calculation worksheet titled: “2022 Crop Insurance Payment Potential”, send an e-mail to: [email protected] 2022 Corn and Soybean Crop Insurance Summary There will be considerable variation in potential crop insurance indemnity payments across the Midwest in 2022, even within the same county or township. Some producers also carried enhanced private insurance coverage levels (90% or 95%), had separate wind or hail insurance endorsements, or carried additional area insurance coverage (SCO or ECO), any of which could affect final potential insurance indemnity payments on the 2022 corn and soybean crop. Producers that had crop yield losses in 2022, with the potential for crop insurance indemnity payments, should contact their insurance agent and properly document yield losses. A reputable crop insurance agent is the best source of information to make estimates for potential 2022 crop insurance indemnity payments or to find out about documentation requirements for crop insurance losses, as well as to evaluate future crop insurance options. Details on various crop insurance policies can be found on the USDA Risk Management Agency (RMA) website at: https://www.rma.usda.gov/.

2 Comments

Read More

Back to Blog

USDA DECREASES CORN ENDING STOCKS10/19/2022 The monthly USDA World Supply and Demand Estimates (WASDE) Report that was released on October 12 will likely impact corn and soybean markets in the coming months. The WASDE Report decreased the expected U.S. corn ending stocks by the end of the 2022-23 marketing year, as compared to the September estimate. The projected soybean ending stocks for 2022-23 in the latest WASDE report remained the same as a month earlier.

|

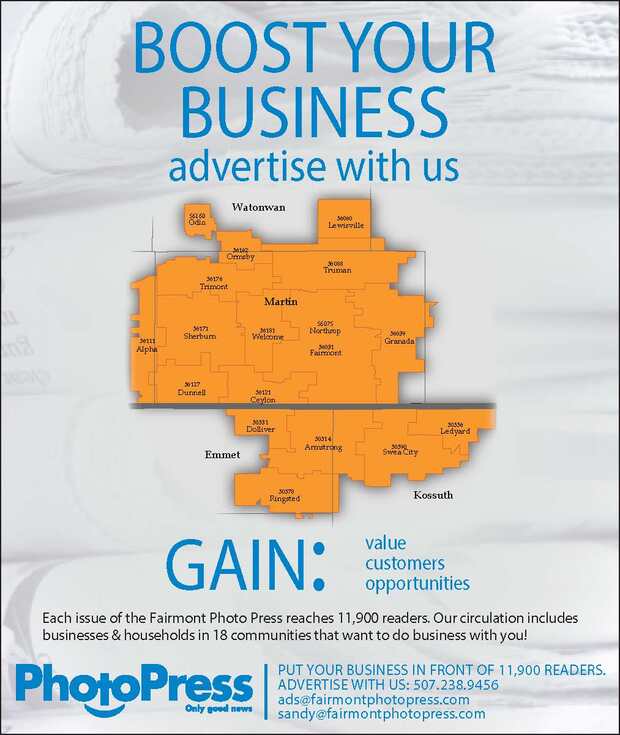

Contact Us:

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed