AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

The University of Minnesota recently reported that the average net farm income for Southern and West Central Minnesota farmers in 2023 was $76,181, which was a sharp decline from the 2022 average net farm income of $311,240. The 2022 net farm income was the highest average net farm income ever recorded in the FBM Summary. The 2023 average net farm income was at the lowest level since 2018 and followed three years (2020-2022) of very strong net farm income levels in the region. The reduction in net farm income levels in Southern and West Central Minnesota were largely driven by reduced crop profits that resulted from much lower grain market prices than 2021 and 2022, along with reduced crop yields in some locations. Livestock profit margins in 2023 in Southern Minnesota were mixed, showing strong profits in beef production but very modest or negative profit margins in dairy and hogs.

The Farm Business Management (FBM) Summary for Southern and West Central Minnesota is prepared by the Farm Business Management Instructors. This summary includes an analysis of the farm business records from farm businesses of all types and sizes in Southern and Western Minnesota. This annual farm business summary is probably one of the “best gauges” of the profitability and financial health of farm businesses in the region on an annual basis. Following are some of the key points from the data in the 2023 FBM Summary: BACKGROUND DATA · The “Net Farm Income” is the return to labor and management, after crop and livestock inventory adjustments, capital adjustments, depreciation, etc. have been accounted for. This is the amount that remains for family living, non-farm capital purchases, income tax payments, and for principal payments on farm real estate and term loans. The average net farm income in 2023 was +$76,181. · The “median” net farm income is the midpoint net farm income of all farm operations included in the FBM Summary, meaning that half of the farms have a higher net farm income and half have a lower net income. The average median net farm income in 2023 was only +$40,039. · A total of 1,590 farms from throughout South Central, Southwest, Southeast, and West Central Minnesota were included in the 2023 FBM Summary. The average farm size was 687 crop acres. The top 20 percent net income farms averaged 1,188 acres, while the bottom 20 percent net income farms had 845 acres. · 62 percent of the farm operations were cash crop farms and 12 percent were single entity livestock operations, with the balance of farms being various combinations of crop, livestock, and other enterprises. · 883 farms (55%) were under $500,000 in gross farm sales in 2023; 354 farms (22%) were between $500,000 and $1 million in gross sales; 263 (17%) were between $1 million and $2 million in gross sales; and 89 farms (6%) were above $2 million in gross sales. · In 2023, the average farm business received only $624 in crop-related government program payments. Livestock-related government payments averaged $9,193, which was largely due to very large Dairy Margin Coverage (DMC) program payments to dairy producers. CRP and conservation payments averaged $1,932. The average level of government payments received by farm businesses has been greatly reduced in recent years compared to levels from 2018-2020. · The average family living expense in 2023 was $78,182, which increased slightly compared to recent years. The average non-farm income in 2023 was $47,214, which represents about 32 percent of total annual non-farm expenses ($151,739) by families for family living and other uses. · In 2023, the average farm business spent $1,298,802 for farm business operating expenses, capital purchases, and non-farm expenses. The total dollars spent by the 1,590 FBM farm families was nearly $2.1 billion. Most of this money was spent in local communities across the region, helping support the area’s overall economy. FARM FINANCIAL ANALYSIS · The average net farm income for Southern and West Central Minnesota for 2023 was $76,181, while the median net farm income for the region was $40,039. This compares to median net farm income levels of $177,614 in 2022, $176,426 in 2021, $102,848 in 2020, $36,547 in 2019, and $20,655 in 2018. · As usual, there was large variation in median farm income in 2023. The top 20 percent profitability farms averaging a median net farm income of +$288,243, which was down from +$728,237 in 2022. The low 20 percent profitability farms with an average median net farm income of negative ($96,605), down from +$13,238 in 2022. · The variation in median net farm income in 2023 also showed some differences based on the gross receipts of the farms. Farms with $1.5 to $2 million in gross receipts had a median net farm income of +$107,644, compared to +$135,680 for farms with a gross of $1 to $1.5 million, +$63,356 for farms with a gross of $500,000 to $1 million, +$38,319 for farms with a gross of $250,000 to $500,000, and +$26,235 for farms with a gross of $100,000 to $250,000. Interestingly, when you look at the profit margin, the smaller volume income groups actually had a higher margin. The $100,000 to $250,000 group was at 31.4% profit margin, the $250,000 to $500,000 group at 26.1%, the $500,000 to $1 million group at 14.5%, the $1 to $1.5 million group at 16.2%, and the $1.5 to $2 million group at 14.2% profit margin. · The average farm business showed working capital of +$469,185 in 2023, which is down 22 percent from 2022 levels but is still 2.5 times higher than the average working capital in 2019. The current ratio (current assets divided by current expenses) for 2023 was 231%, which compares to 283% in 2022, 247% in 2021, 198% in 2020, and 156% in 2019. The working capital to gross revenue ratio for 2023 was 44.5%, which is still at a very strong level compared to the much more challenging levels in 2018 and 2019. · Another measure of the “financial health” of a farm operation is the “term debt coverage ratio”, which measures the ability of farm operations to generate adequate net farm income to cover the principal and interest payments on existing real estate and term loans. If that ratio falls below 100%, it results in the farm business being required to use working capital or non-farm income sources to cover the difference. The average term debt coverage ratio for 2023 dropped considerably to a level of 125%, which was the lowest since 2018. This compares to average ratios of 372% in 2022, 389% in 2021, 274% in 2020, and 148% in 2019. The bottom 40 percent profitability farms had an average term debt coverage ratio below 100% in 2023. · The overall solvency of the 1,590 farm businesses in the FBM program have remained fairly stable in recent years. The average debt/asset ratio in 2023 was 43%, which was has been nearly steady for the past four years. The debt/asset ratio for the lowest 20 percent profit farms was 49% and was 38% for the 20 percent highest profit farms. The average farm listed just over $3 million in total farm assets, just over $1.14 million in farm liabilities, for an average farm net worth of approximately $1.8 million. BOTTOM LINE Overall, net returns from crop operations in 2023 were down considerably from the very strong farm profit levels in 2022 and 2021. As usual, there was a wide variation in farm profit levels from the top one-third of net farm income operations as compared to other farms. The overall average financial health of most farm businesses remains quite solid due to strong working capital and cash surpluses from 2021 and 2022. The reduced net farm income levels in 2023 point to some “caution flags” on the horizon for farm profitability. These include rapidly continued high input expenses and land costs, continued sluggish grain prices, and inconsistent livestock profitability. Complete farm business management results are available through the University of Minnesota Center for Farm Management FINBIN Program at: https://finbin.umn.edu/ Note --- For additional information contact Kent Thiesse, Farm Management Analyst, Green Solutions Phone --- (507) 381-7960; E-mail --- [email protected]

0 Comments

Read More

Leave a Reply. |

Contact Us:

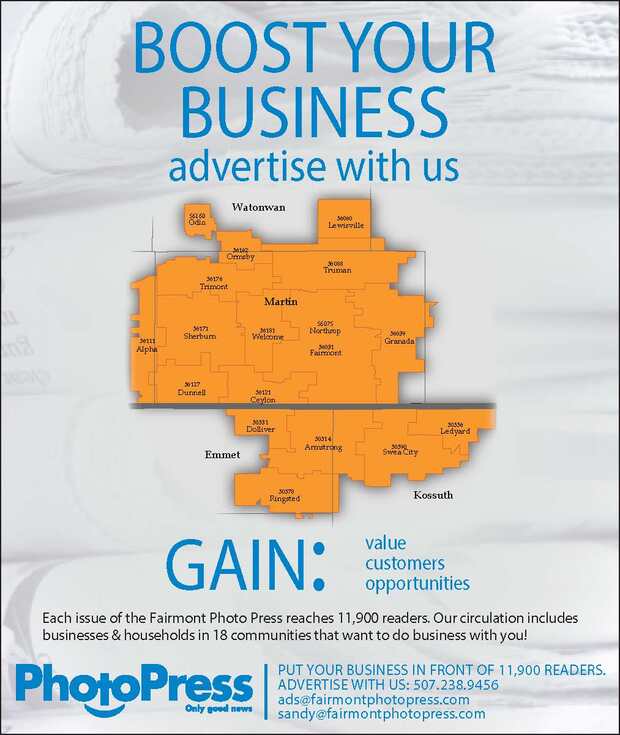

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed