AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

On any given day, farm operators and others can get grain price quotes from the CME Group, also known as the Chicago Board of Trade (CBOT), in “real-time” on their computer or I-phone. Almost as quickly, they can get current and future corn and soybean market price quotes from local grain elevators, ethanol plants, and processing plants. The difference between the local grain price and the CBOT price is known as “basis”. Understanding how basis works and the seasonal trends associated with basis can be an important factor in making corn and soybean marketing decisions.

More specifically, “basis” is the difference between the local grain price quote on a specific date and the CBOT price for the corresponding futures contract month. Local harvest price quotes for corn and soybeans would typically correspond to the December CBOT corn futures price and the November CBOT soybean futures price. By comparison, storing the corn or soybeans after harvest and selling the grain via a forward contract in June or early July the following Summer would have the basis level correspond to the July CBOT corn or soybean futures. A “narrow” or “tighter” basis means that the local corn or soybean price is getting closer or above the corresponding CBOT price, while a “wide” or “widening” basis reflects local grain prices that have a greater margin below the CBOT prices. In many years up until recently, farmers in the Upper Midwest dealt with “negative” basis levels, which means than local corn and soybean prices are lower than the corresponding CBOT prices. Areas near the Mississippi River ports or in the Southern U.S more typically have “positive” basis levels, where local grain prices are higher than CBOT prices. However, there have been several areas of the Upper Midwest that have had “positive” basis levels for corn and soybeans at certain times during 2021 and 2022. While the definition of “basis” may seem quite simple, the dynamics of understanding basis can be quite complex. Basis is variable at different locations and can vary throughout the year, or suddenly be adjusted due to changing dynamics in grain market fundamentals. Following are the main factors that affect basis and can lead to changes in basis levels:

There is currently a wide range in harvest-time corn basis levels the Midwest, depending on 2022 corn yields and demand for corn usage. For example, in portions on Nebraska and Kansas that were impacted by the drought in 2022, the early November corn basis level is +$.50 to +$1.50 above the nearby CBOT December corn futures price, which is a much different pattern than normal. By comparison, corn basis levels in areas of Southern Illinois are ($.50) to ($1.00) per bushel below December CBOT price, which is a much wider basis level than normal, resulting from reduced barge traffic on the lower Mississippi River due to low water levels. The national average corn basis level on November 3 was +$.05 per bushel above the CBOT December futures price. The corn basis level on November 3 in Southern Minnesota ranged from about ($.25) per bushel under the CBOT December futures price to +$.15 above the CBOT price. Soybean basis levels in Southern Minnesota on November 3 generally ranged from ($.15) under to +$.05 over the CBOT January futures price, with some soybean processing plants as high as +$.40 above the futures price. In the six years (2015-2020) prior to 2021, early November corn basis levels in Southern Minnesota had typically averaged ($.35) to ($.45) per bushel below the nearby CBOT futures price and soybean basis levels were ($.40) to ($.90) per bushel under futures prices. Currently, many farmers are quite “bullish” about grain market prices in 2023, meaning that they feel there is a good chance of corn and soybean prices rising in the coming months. The current basis levels for both crops in many areas are encouraging producers to sell their grain in the next few months, rather than waiting until next Summer to market the grain. Corn futures and cash prices are currently projected to stay fairly steady from now until July of 2023, meaning there is very little difference in the expected basis levels by next Summer. At soybean processing plants in Southern Minnesota, the soybean basis was +$.40 per bushel on November 3, compared to minus ($.15) per bushel in July of 2023, so even though the CBOT futures price for July is $.16 per bushel higher than the January price, the cash soybean bid for July is ($.39) per bushel lower than the current cash bid. There are several grain marketing tools available for farmers to utilize besides cash sales, including a variety of hedging, options and basis contracts, Typical hedging or options contracts lock in the CBOT futures price but not the cash price, meaning that there is still basis risk. For example, a “hedge-to-arrive” contract locks in a CBOT futures price but the basis is not finalized until the futures contract is cleared and the grain is sold. By comparison, a basis contract locks in the basis but keeps the final price open depending on changes in the corresponding CBOT futures price and actual cash price at the time of delivery. Depending on an individual’s willingness to assume some market risk, they could also sell the grain for cash to realize the advantage of the current basis levels and take a CBOT options or futures price position to keep some upside potential in the corn and soybean markets. Most grain marketing strategies, including storing unpriced grain in a bin on the farm, involve some level of price and/or basis risk. Understanding the dynamics of basis in corn and soybean market prices is a key element in analyzing the various types of grain marketing contracts that are available to farm operators. Iowa State University has some good information available on understanding basis and various grain marketing strategies. This information is available on the “Ag Decision Maker” website at: https://www.extension.iastate.edu/agdm

0 Comments

Read More

Leave a Reply. |

Contact Us:

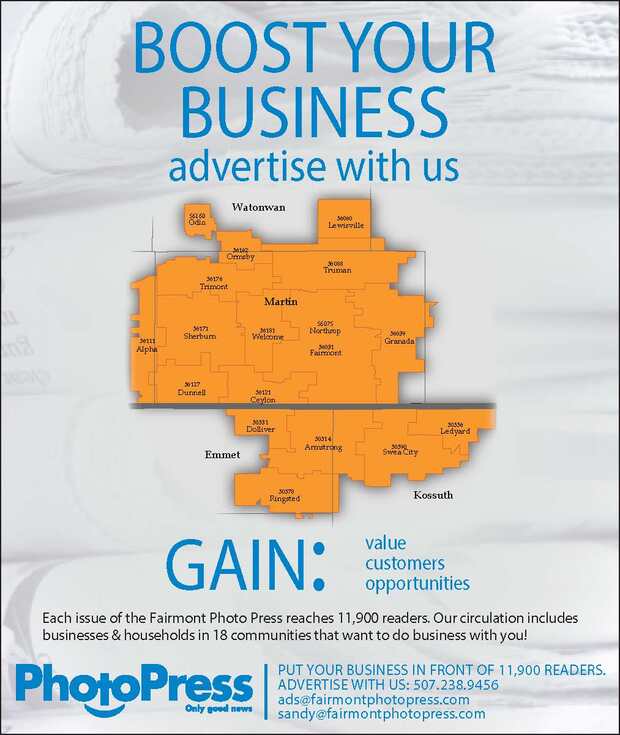

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed