AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

FARM BILL EXTENSION APPEARS LIKELY9/6/2023 Even though Congress has held multiple hearings and listening sessions during the past several months, it does not appear likely that we will have a new Farm bill in place when the current Farm Bill expires. The current Farm Bill, known as the “Agriculture Improvement Act of 2018”, expires on September 30, 2023, and included coverage of the 2023 crop year. At this point, no formal legislation for a new Farm Bill has been proposed in either house of Congress. Once a formalized Farm Bill is proposed and discussed, it will need to be passed by both houses of Congress and signed by President Biden before it can be enacted. Most likely, much of the funding allocated in the current Farm Bill will be extended through pending actions by Congress on the Federal budget.

When most people hear of a “Farm Bill”, they think of the commodity programs and payments that affect crop producers. Some people may be aware that crop insurance and conservation programs are included under the Farm Bill, and some are knowledgeable that Supplemental Nutrition Assistance Program (SNAP) and food stamps are part of the Farm Bill legislation. However, very few people outside of government officials and policy experts are aware that the Farm Bill also covers funding for rural fire trucks and ambulances, export promotion, international food aid, forestry programs, ag research and extension education at land-grant universities, and school lunch programs. The current Farm Bill passed in 2018 was over 1,000 pages in length, and contains 12 separate Titles, which cover a multitude of programs that are administered by USDA. Farm Bills date back to Great Depression era of the 1930’s, with the first Farm Bill having just two Titles and being only 54 pages in length. The “Agricultural Adjustment Act of 1933” established the crop loan program, which is still in existence today. Under the crop loan program, producers can take out a low interest loan with USDA, using the crop as collateral before it is sold. The producer can either repay the loan principal plus interest when the crop is sold or can forfeit the crop to USDA. Over the past several decades, the crop loan program has been used extensively by farm operators to get needed working capital for purchasing crop inputs for the following crop year. Most national crop loan rates were increased as part of the 2018 Farm Bill, and some groups are pushing for further increases in the commodity loan rates in the next Farm Bill. Land set aside and conservation programs were added to Farm Bills in the 1950’s, with the establishment of the “Soil Bank Program”. While the Soil Bank Program no longer exists, there have been many other set-aside and conservation programs, including the popular “Conservation Reserve Program” (CRP) that was added in the 1985 Farm Bill. The 2014 Farm Bill reduced the maximum CRP acreage from 32 million acres to 24 million acres, which was the lowest level since the initiation of the CRP program, which was gradually increased back to 27 million acres in the current Farm Bill. There are also several other conservation programs that are part of the current Farm Bill, including the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP), and the Agricultural Conservation Easement Program (ACEP). There are efforts by some members of Congress, as well as agricultural and environmental organizations, to have Farm Bill programs more directly linked with practices that enhance carbon sequestration efforts. Food stamps were added to Farm Bill in 1973, with the program being administered by USDA. Over 80 percent of the proposed funding for the next Farm Bill will go to SNAP related programs, which includes the food stamp program, the women, infants, and children (WIC) program, and the school lunch program. The Federal budget outlay for the SNAP program more than doubled from 2008 to 2013, then declined briefly before increasing again since 2020, due to the economic challenges caused by the COVID pandemic. Some members of Congress and other groups would like to see the Nutrition Title and SNAP programs removed from the Farm Bill. However, the Nutrition Title programs are important to nearly every member of Congress, including those in urban areas, which keeps all members engaged in Farm Bill discussions and the importance of food and agriculture. About 10-12 percent of the funding in the proposed Farm Bill will be targeted for farm commodity programs and crop insurance programs. The current Farm Bill provides eligible crop producers the choice between the county revenue based “Ag Risk Coverage” (ARC-CO) program, or the price-only “Price Loss Coverage” (PLC) program, for corn, soybeans, wheat, and other eligible commodity crops. The ARC-CO program is based on actual county crop yields and national average crop prices for a given crop year, compared to 5-year average benchmark yields and prices. The PLC program payments are based on national average crop prices for a given year compared to present crop reference prices. Some farm organizations are pushing for higher crop reference prices in the next Farm Bill, given the much higher crop input costs that have occurred in the past couple of years. The current Farm Bill does allow for small gradual increases in the crop reference prices during extended periods of higher commodity prices. The dairy margin protection program and sugar support programs are also included under the commodity title of the Farm Bill. Most crop producers and ag lenders will highlight a sound working crop insurance program as the “centerpiece” for a solid risk management plan in a farm operation. Over 95 percent of the corn and soybean acres in the Upper Midwest are typically insured by some type of crop insurance coverage. Most crop insurance premiums are subsidized at a rate of 60-65 percent by the federal government, as part of the Farm Bill. Some members of Congress and some organizations are calling for some changes and modifications to the current Federal Crop Insurance program, while most farm organizations are lobbying to keep the current program. Some livestock producer organizations would like to see enhancements to risk management programs for livestock production. Since the first Farm Bill in 1933, there have been 17 different Farm Bills in the past 90 years, with the next Farm Bill scheduled to be finished in the coming months. New Farm Bills are usually written about every five years, with the longest period between new Farm Bills being nine years from 1956 to 1965, and the shortest period being one year from 1948 to 1949. The “Agricultural Act of 1949”, which is also known as the “permanent farm legislation”, was never repealed or allowed to expire, and becomes the Farm Bill legislation for many commodity programs if a new Farm Bill is not enacted when the previous Farm Bill expires. Many provisions in the 1949 legislation are very outdated and did not include the SNAP program, the current crop insurance program, or many popular ag and conservation programs, including CRP. The existence of the fallback to the 1949 legislation gives Congress extra incentive to complete Farm Bills in a timely manner. The passage of a new Farm Bill is very complex, with programs ranging from farm commodity programs to food and nutrition programs, from conservation programs to rural development programs, and many more. In many cases, finalizing a Farm Bill in Congress can be quite controversial, and not necessarily by political party lines. The various Farm Bill programs become quite geographical, with members of Congress wanting to protect the farm, food and nutrition, conservation, and economic interests of their State or Congressional district. The very large federal budget deficit in recent years has added a new element to successfully passing a new Farm Bill. The last Farm Bill was written in 2018, to cover federal fiscal years from 2019-2023; however, Congress has been known to extend Farm Bills beyond the expiration date. Thus far, the discussion has been to have a new Farm Bill completed by the time the current Farm Bill expired on September 30, 2023, or shortly after. Ultimately, there will likely be a compromise reached, and a new 5-year Farm Bill will be passed sometime later this year, or more likely in 2024. Given the current political division that exists in Congress and the other legislative issues, it is appearing likely that a one-year extension of the current Farm Bill is quite possible. From a commodity program standpoint, this would likely extend the current farm program provisions for an additional year in 2024.

0 Comments

Read More

Leave a Reply. |

Contact Us:

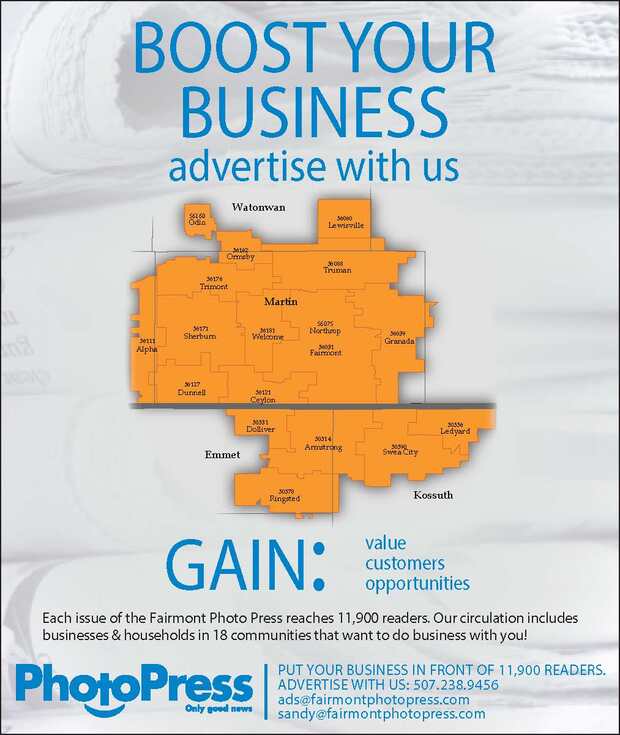

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed