AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

From 2021 until early 2023, nearby futures prices on the Chicago Board of Trade (CBOT) for both corn and soybeans have been at the highest sustained levels since the period a decade earlier from 2011 to 2013. This has allowed for some excellent profit margins for Midwest corn and soybean producers in the past two years, especially for farmers that had average or above average crop yields in 2021 and 2022. Now there are some indicators on the horizon that this prolonged period of robust crop prices might be changing later this year, which could result in profit margins becoming much tighter by the end of 2023.

Nearby CBOT May corn futures closed at $6.51 per bushel following the release of the World Supply and Demand (WASDE) report on April 11, which compared to a nearby futures price of $7.84 per bushel following the April WASDE report in 2022 and $5.77 per bushel in 2021. The nearby CBOT corn futures price has exceeded $5.00 per bushel since early 2021 and has been above $6.00 per bushel since early 2022, exceeding $7.00 per bushel from March until June in 2022. Prior to 2021, the nearby corn futures price had not been above $5.00 per bushel since late Summer of 2013. In fact, from 2015 through 2020, nearby corn futures were below $4.00 per bushel for a high percentage of the time. The last extended period of higher levels of CBOT corn futures prices occurred from late 2010 through 2013. Nearby corn futures rose above $5.00 per bushel in September of 2010, exceeding $6.00 per bushel by early 2011, and going over $7.00 per bushel by June of 2011. Corn futures stayed strong in 2012, only briefly dipping below $6.00 per bushel, before reaching the all-time high of $8.38 per bushel during the intense U.S. drought conditions in August of 2012. Nearby corn futures stayed above $7.00 per bushel for the balance of 2012 and remained above $6.00 per bushel for most of the first half of 2013, before dropping significantly in the second half of 2013, ending the year near $4.25 per bushel. By the Summer of 2014, nearby corn futures had dropped to near $3.50 per bushel and only briefly topped $4.00 per bushel during the next several years. Nearby CBOT May soybean futures closed at $14.97 per bushel following the release of the WASDE report on April 11, which compared to $16.65 per bushel following the WASDE report in 2022 and $14.03 per bushel in 2021. Similar to corn, the nearby CBOT soybean futures price has exceeded $12.00 per bushel since late in 2020 and has been above $13.00 per bushel since early 2021, except for a few months in the Fall of 2021. Nearby soybean futures prices have exceeded $14.00 per bushel most of the time since early 2022, trading above $16.00 per bushel from late February to mid-June in 2022. On April 17, May CBOT soybean futures were trading at $15.10 per bushel for May, which drops to $14.79 per bushel for July and $13.43 per bushel for September. Prior to late 2020, the nearby soybean futures price had not exceeded $12.00 per bushel since late Summer of 2014. During the last grain price “boom period” from late 2010 through 2013, the nearby soybean futures rose above $12.00 per bushel in October of 2010 and exceeded $13.00 per bushel the end of 2010. The nearby soybean futures stayed above $13.00 per bushel throughout the Summer of 2011, before falling back below $12.00 per bushel that Fall into early 2012. Soybean futures rebounded quickly in the drought year of 2012, exceeding $13.00 per bushel by March and $16.00 per bushel by July, reaching the all-time high of $17.68 per bushel in September of 2012. Nearby soybean futures remained above $14.00 per bushel until the Summer of 2013 and stayed near or above $13.00 per bushel for the balance of 2013. After spending the first half of 2014 above $13.00 per bushel, nearby soybean futures dropped to near $10.00 per bushel during most of the second half of 2014. From mid-2018 through mid-2020, nearby soybean futures traded below $9.00 per bushel a majority of the time, due to export market implications resulting from the U.S. trade war with China. The current strength in both the CBOT prices and the local cash grain prices for corn and soybeans has been driven by a combination of fairly tight U.S. and World grain stocks and very strong domestic and export demand for both commodities, along with lower than anticipated U.S. corn and soybean production in 2020 and 2021. The commodity markets have gained further strength at certain times in past two years resulting from the impacts on World grain markets resulting from the Russian war in Ukraine, as well as some corn and soybean production issues due to drought conditions in South America during the past two years. The “basis” level for local corn and soybean cash price bids has remained at fairly tight levels in 2022 and early 2023. The “basis” is the difference between the local cash price being offered in a given month and the closet CBOT futures price. Many processing plants and local elevators in the Corn Belt have offered cash prices with a positive basis at certain times during the past two years. The current basis level for cash corn in Southern Minnesota has remained near or above the nearby CBOT futures price in recent weeks. The soybean basis level in the region have at soybean processing plants have remained near the CBOT nearby futures price, while basis levels at local grain elevators have generally been $.20-$.40 below the CBOT futures prices. The tight basis levels have offered some very good grain marketing opportunities for 2022 grain inventories in recent months. The corn basis level for the Fall of 2023 has widened out to approximately $.30 to $.50 per bushel under the CBOT December futures price at local ethanol plants and grain elevators in Southern Minnesota. The soybean basis for the Fall of 2023 has been near $.35 per bushel at soybean processing plants and $.50 to $.70 per bushel below the CBOT November futures price at grain elevators. This is more typical of Spring levels that existed prior to 2021 and 2022 for corn and soybeans. The basis levels at local grain elevators and processing plants are important to farm operators for determining pre-harvest market strategies for corn and soybeans in a given year. Once farm operators reach planting season, they pay close attention to “new crop” December corn futures and cash prices for harvest season and beyond at local grain elevators and processing plants. December corn futures closed at $5.59 per bushel on April 11, which compares to $7.35 per bushel in mid-April a year ago and $5.77 per bushel in 2021. Cash bids for Fall delivery of the 2023 corn crop at local grain elevators and ethanol plants in Southern Minnesota on April 11 ranged from $5.00 to $5.30 per bushel at many locations, compared to $6.50 to $7.00 per bushel a year ago. In late Fall of 2012, local new crop corn prices for the Fall of 2013 were near $6.00 per bushel; however, by July of 2013 new crop bids had declined below $5.00 per bushel, with the 2013 cash corn price ending the year near $4.00 to $4.25 per bushel. Prices for 2023 “new crop” CBOT November soybeans closed at $13.13 per bushel on April 11, which compares to just over $15.00 per bushel in mid-April of 2022 and $12.63 per bushel in 2021, Cash bids for 2023 “new crop” soybeans at grain elevators in Southern Minnesota on April 11 ranged from $12.00 to $12.50 per bushel, with forward prices near $12.75 per bushel at soybean processing plants. These prices are about $2.00 per bushel lower than Fall harvest soybean bids a year ago. Cash soybean prices in Southern Minnesota were near $12.50 to $13.00 per bushel in the Fall of 2013; however, prices had declined to below $10.00 per bushel by the Fall of 2014. Most farmers have been pondering over grain marketing decisions for the 2023 corn and soybean crop in recent weeks. Break-even levels to cover direct and overhead expenses on cash rented land in 2023 will likely be $5.00 to $5.50 per bushel for corn and over $11.00 per bushel for soybeans for many Midwest crop producers. In many years, the Spring and early Summer months tend to offer some of the best opportunities to forward price “new crop” corn and soybeans. On the other hand, farmer operators do not want to miss the opportunity for a grain price “run-up” later this year, such as occurred in the past couple of years when U.S. crop yields were lower than expected. If there is not a drought or other crop issues in the U.S. in 2023, corn and soybean prices are likely to follow a more typical seasonal price pattern as we progress toward harvest this year.

0 Comments

Read More

Leave a Reply. |

Contact Us:

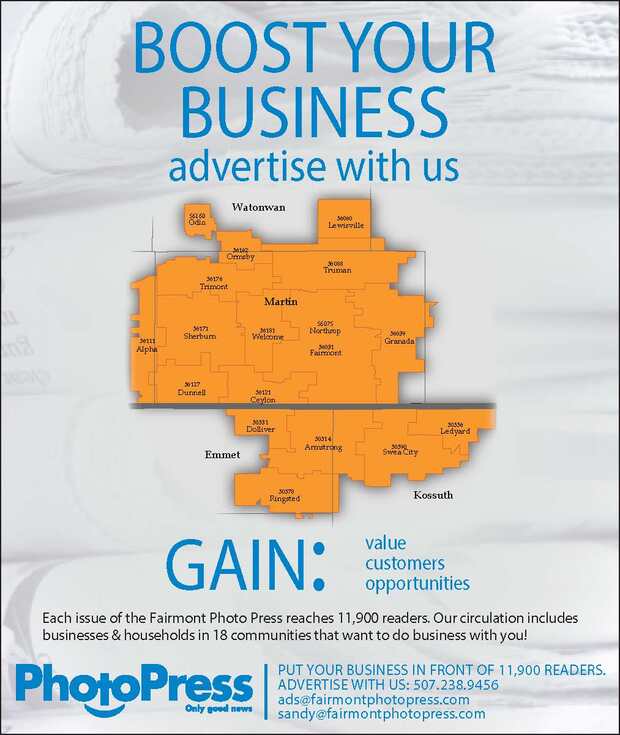

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed