AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

In late August, President Biden signed the “Inflation Reduction Act of 2022” (IRA) into law. The IRA was previously passed by the U.S. Senate by a slim margin and later approved by the U.S. House of Representatives. In both Houses of Congress, the IRA Bill passed along party lines with support from Democratic members of Congress and opposition from Republican members of Congress. The opposition was largely due to the rather large cost of the legislation and questions as to whether the legislation could accomplish all the goals and objectives that were set forth in promoting the Bill.

|

Contact Us:

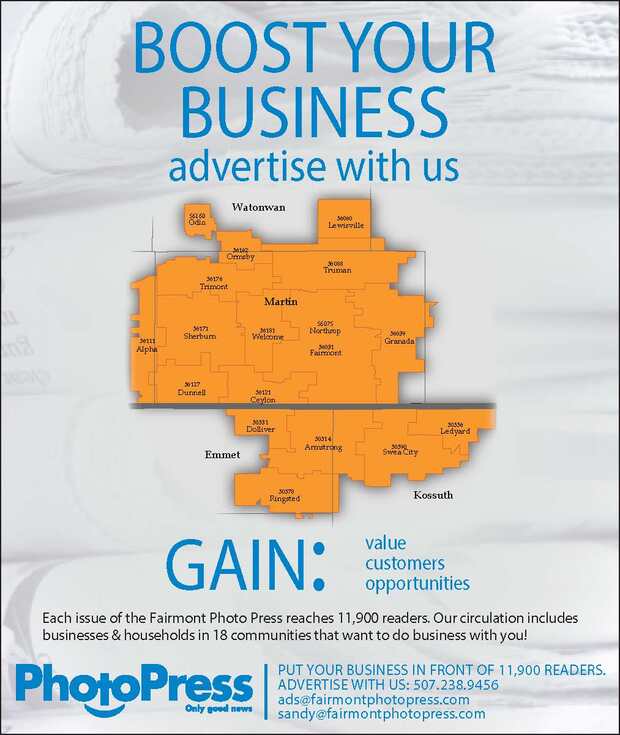

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed