AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

There has finally been some movement on potential approval of a long-awaited new Farm Bill. In mid-May, U.S. House Agriculture Committee Chairman, Congressman Glenn (GT) Thompson (R-PA) released the text for the initial version of the U.S. House Farm Bill, which is titled: “Farm, Food and National Security Act of 2024”. The version of the House Farm Bill has generally been viewed as “farmer-friendly” by some ag policy analysts; however, there have been negative reviews from some members of Congress and by some organizations. The entire U.S. House Agriculture Committee approved the initial House Farm Bill on May 24; however, only 4 Democratic members on the committee supported the House Farm Bill. The U.S. Senate Agriculture Committee has also released some initial provisions likely to be included in the Farm Bill.

• The 2023 crop year was set to be the final year for the 2018 Farm Bill; however, the Farm Bill was extended for the 2024 federal fiscal year and is now set to expire on September 30, 2024. Farm Bills are one of the most comprehensive pieces of legislation that are passed by Congress, with programs ranging from farm commodity programs to food and nutrition programs, from conservation programs to rural development programs, and several more. In many cases, finalizing a Farm Bill can be quite controversial, both along political party lines and geographical differences, with members of Congress wanting to protect the farm, food, conservation, and economic interests of their State. • Following are some initial details for commodity programs and crop insurance from the new Farm Bill proposal that was passed by the U.S. House Ag Committee: – Increases the “statutory reference prices” (SRP) for all commodities by 10 to 20 percent. The SRP sets the minimum reference price for farm program commodities that is used to calculate price loss coverage (PLC) and ag risk coverage (ARC) program payments. It would increase the statutory reference price for corn to $4.10/bu., soybeans to $10.00/bu., and wheat to $6.35/bu. – The formula to calculate the “effective reference price (ERP) would be continued in the next Farm Bill. The ERP is calculated by taking 85 percent of the national market year average (MYA) price of the five years previous to the year preceding the current program year, dropping the high and low price, and averaging the other three years. The final ERP each year is the higher of the calculated price and the statutory reference price. – Increases the ARC guarantee to 90 percent of the benchmark revenue (currently 86 percent) for both the county-yield based ARC-CO program and the individual yield based ARC-IC program. It would also increase the maximum ARC payment to 12.5 percent of the ARC revenue (currently 10 percent). – Increases the marketing assistance loan (MAL) rates for most commodities. – Provides an opportunity to add new crop base acres for farms that currently have no base acres or that have been planted to more acres of program crops than the existing base acres. This provision would not affect existing crop base acres but would be in addition to those base acres. – Would increase the farm program payment limit to $155,000 for any eligible individual earning at least 75 percent of their income from farming (currently at $125,000) and this payment limit would be indexed to inflation going forward. Would also adjust payment limit language to be comparable for farm LLC business structures as currently exists for farm general partnerships. – Would increase the supplemental crop option (SCO) crop insurance coverage up to 90 percent of the county yield times the spring crop insurance price (currently the SCO coverage is at 86 percent). The cost of SCO coverage would be subsidized by the federal government at 80% (currently 65%). – Would also enhance “whole-farm” revenue protection crop insurance products and provide added crop insurance options for specialty crops. Initial U.S. Senate Farm Bill proposals for the commodity and crop insurance titles …... Senator Debbie Stabenow (D-MI), Chair of the U.S. Senate Agriculture Committee, has not released the official text for the Senate Farm Bill; however, some initial likely provisions have been released. Here are some of those likely commodity and crop insurance title provisions from the Senate Farm Bill proposal: – Maintains the current PLC and ARC program choice for eligible commodities and keeps the formula for payment acres the same as the current Farm Bill. – Increases the minimum statutory reference prices (SRP’s) for all farm program commodities by 5 percent and continues the formula for calculating the effective reference prices (ERP). – Would establish a maximum PLC payment rate at 20 percent of the reference price for a commodity. Currently the maximum PLC payment rate is the difference between the reference price and the marketing loan rate for that commodity. For example …… the 2024 corn reference price is $4.01 per bushel and national corn loan rate is $2.20 per bushel, so the maximum PLC protection is $1.81 per bushel; however, under the proposed Farm Bill the maximum would be reduced to $.80 per bushel. – Increases the ARC program guarantee to 88 percent of the benchmark guarantee (currently 86%) but would continue the maximum ARC payment at 10 percent of the benchmark guarantee. – Provides limited opportunity for underserved farmers to update crop base acres and establish farm program yields. This would differ from the broader base acre update proposal in the House Farm Bill, – Marketing assistance loan (MAL) rates for eligible commodities would be indexed to the USDA Economic Research Service (ERS) five-year cost of production for a given commodity. – Would restrict commodity program payments from being made on land owned by individuals or legal entities with an adjusted gross income (AGI) exceeding $700,000. If is not clear how this might impact farm program eligibility for farm operators that rent farm land from individuals exceeding that limit. – Enhances crop insurance premium subsidies for beginning farmers in their first ten years of farming. – Increases the SCO crop insurance coverage to 88 percent (currently 86%), similar to maximum ARC farm program coverage and expands SCO coverage to more crops. The SCO federal premium subsidy would increase to 80 percent of the insurance premium (currently at 65 percent). • As can be seen, there are some differences in the commodity and crop insurance proposals in the U.S. House and Senate versions of a new Farm Bill; however, most of those differences could likely be worked out through the conference committee process. The Senate Farm Bill would greatly expand many of the programs in the conservation title of the Farm Bill and links many of those programs to the so-called “climate-smart” agricultural practices that have been identified through the climate programs that are being initiated through the climate funding in the Inflation Reduction Act (IRA) that was passed in 2023. The Senate Farm Bill also would not place any restrictions on eligibility for SNAP and other programs under the nutrition title of the Farm Bill, while the House Farm Bill would place some restrictions on certain aspects of these programs. The biggest difference may likely come down to how the funding is allocated in the Farm Bill. The proposed House Farm Bill would significantly increase spending for commodity programs and crop insurance, while the Senate Farm Bill would likely add more spending to the conservation and nutrition titles of the Farm Bill. • The initial release of some details for the new Farm Bill and the action by the U.S. House Agriculture Committee has provided some optimism regarding the completion of a Farm Bill by the end of 2024; however, many steps remain to complete that process. Once a Farm Bill is approved by both houses of Congress, a conference committee will need to work differences in the House and Senate versions of the Farm Bill and have it re-approved in both houses of Congress, before ultimately sending it to the President for final approval. This will likely need to happen by the end of 2024 or very early in 2025 to make it possible for the new legislation to be implemented for the 2025 crop year. Ultimately, a compromise will likely be reached and a new 5-year Farm Bill will be passed; however, given the political division that currently exists in Congress, this may be difficult to accomplish in 2024. As a result, another one-year extension of the current Farm Bill for 2025 is certainly a possibility. Note - For additional information contact Kent Thiesse, Farm Management Analyst, Green Solutions Phone - (507) 381-7960; E-mail - [email protected]

0 Comments

Read More

Leave a Reply. |

Contact Us:

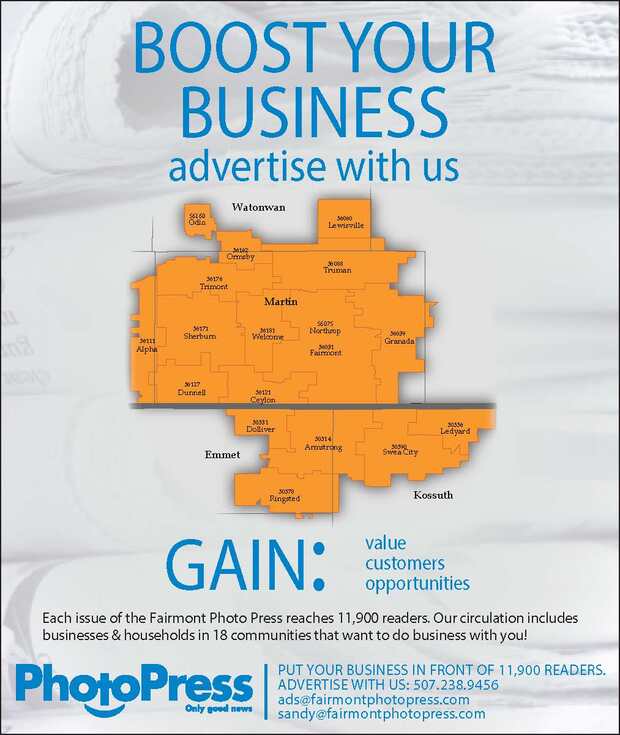

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed