AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

Record grain prices, high farm profit levels, rapid increases in land values, large capital purchases on the farm, and strong optimism about the future of the farm economy. Sound familiar …… that was the situation in the late 1970’s; however, it also very similar to current farm economic situation in many areas of the United States. Of course, what followed in the 1980’s was the worst agriculture economy in the U.S since the Great Depression of the 1930’s, which resulted to extreme financial and mental stress for a large number of farm families, as well as leading to many forced farm sales and foreclosures. The farm stress of the 1980’s was caused by rapidly rising inflation and farm input costs, reduced commodity prices and poor farm profit levels, greatly reduced land values, and high interest rates, as well as by not adjusting to a changing farm economy.

Following are some factors to consider with today’s farm economy: · Nearby soybean futures on the Chicago Board of Trade (CBOT) have traded above $12.00 per bushel since the beginning of 2021 and above $14.00 per bushel for much of 2022, reaching a high of $16.00-$17.00 per bushel in the Spring of 2022. Soybean futures prices were below $9.00 per bushel as recently as the first half of 2020. The last time we had an extended period of high CBOT soybean futures prices of $13 to $16 per bushel was from 2011 through the first half of 2014, reaching a high of $17.68 per bushel in September of 2012. By the end of 2015, soybean futures prices had retreated to below $9.00 per bushel. · Similarly, nearby CBOT corn futures have traded above $6.00 per bushel for most of 2022, which compares to $3.25-$3.50 per bushel in the first half of 2020. Similar to soybeans, the last extended period of strong corn prices was from 2011 through the first half of 2013, when CBOT nearby corn futures price also traded above $6.00 per bushel most of the time, reaching a high of over $8.00 per bushel in the fall of the drought year of 2012. By mid-year of 2014, corn futures prices had dropped below $4.00 per bushel. · According to the most recent USDA Economic Research Service (ERS) Farm Income Forecast on December 1, 2022, “net farm income” in the U.S. for 2022 is projected at $160.5 billion, which would be an increase of 12.8 percent or $19.5 billion from the $140.5 billion level in 2021. In the six previous years (2015-2020), the U.S. net farm income was below $100 billion. · The last period of very strong net farm income levels in the U.S, occurred from 2011 to 2013. The average annual U.S. net farm income over the past two decades (2002-2021) was $104 billion per year. The very strong U.S. farm income levels in the past two years has been driven by strong commodity prices, improved livestock profitability, and excellent export levels of farm products to China and other countries. · According to the latest ERS estimates, total farm expenditures in the U.S. are expected to increase by $69.9 billion or 18.8 percent, as compared to a year earlier, with fertilizer expenses leading the way with at a 47 percent increase year-over-year. The ERS also projects increased input costs for crop chemicals, diesel fuel, repairs, and farm labor, as well as livestock expenses. Farm input costs will likely be even higher in 2023. · The U.S. Federal Reserve has increased the prime interest rate to 7 percent in early November, with the potential for another increase before the end of the year, which compares to a rate of 3.25 percent in the first few months of 2022. Farm operators that are paying 4 percent interest for a one-year operating loan in 2022 could likely be paying an interest rate of 8 to 9 percent for 2023. For farmers that rely on short-term credit during the year, this could easily add $15,000 to $25,000 to their farm operating costs in 2023. · According to the USDA Land Value Summary Report, released in August of 2022, farmland values in the U.S. in 2022 averaged a record $3,800 per acre, which was an annual increase of 12 percent from mid-year of 2021. The $420 per acre increase nationally from 2021 to 2022 was the largest year-over-year increase ever recorded. The highest annual percentage increases in farmland values from 2021 to 2022 were 25 percent in Kansas, 21 percent in both Iowa and Nebraska, 19 percent in South Dakota, and 17 percent in Minnesota. Land values in many of those areas have continued to increase in recent months. Many farmers and others in the agriculture industry remain very “bullish” on the future profitability in production agriculture and the overall U.S. agriculture economy. Until recently, it has been hard to find many people talking about a potential downturn in the agriculture economy anytime soon. Usually, when everyone is thinking one direction is when things change, and sometimes those changes can occur quite rapidly. In 1980, following some very robust farm income years, the U.S. Government implemented a grain embargo that caused a rapid decline in grain exports and resulted in much lower grain prices. This rapid drop in grain prices, along with lower farm profits, and much higher interest rates, led to the farm crisis of the 1980’s. While economic conditions in the U.S. today are much different than in the late 1970’s and early 1980’s, there are some “yellow caution flags” to think about with today’s agriculture economy: · The cost of production for corn and soybeans, including feed, fertilizer, chemicals, seed, fuel, and other expenses is expected to increase again for 2023 and will be nearly double the cost of production a few years ago. The increased cost of production, combined with the increased land rental rates and higher interest rates means that the break-even price in 2023 for corn production for many farm operators in the Midwest will likely be $5.50 to $6.00 per bushel for corn, and over $12.00 per bushel for soybeans, after being below $4.00 per bushel for corn and below $9.00 per bushel for soybeans as recently as 2020. · If the high inflation rates continue into 2023 and beyond, it could impact consumer buying habits for some food items, such as high-end meat and dairy products, which could greatly affect livestock profit margins. · There is growing concern regarding the future level on ag exports, given the continuing Russian war in Ukraine, growing U.S. trade tensions with China, and other worldwide political issues. · The renewable fuel industry is kind of at a crossroads …… there is optimism surrounding the potential for higher blends of ethanol, increased production of renewable biodiesel, and development of sustainable aviation fuel. On the other hand, the “green energy” movement toward a rapid increase in electric vehicles and less use of traditional fuels could lower future demand for ethanol and traditional soybean diesel. · Land values dropped by 40 to 60 percent in many areas during the 1980’s following their peak values in the late 1970’s. More recently, Iowa average farmland values dropped by 16 percent from 2014 to 2018 after the last peak in land values in 2013. Many analysts expect land values to plateau and possibly decline again in the coming years beyond 2023, following the current rapid rise in land values in 2021 and 2022. · In 2020, we experienced the serious economic impact that a major human disease pandemic such as COVID can cause on the U.S. and worldwide economy, including the ag economy, How well are we prepare to withstand future pandemics, terrorist attacks, and other factors beyond a farmers control that could impact the financial well-being of individual farm businesses and the overall U.S. ag economy ? · During recent events such as COVID, the trade war with China, and natural disasters, the Federal government has provided significant financial aide to farm operators to help offset reduced income. Many analysts wonder if the next Farm Bill and other government programs will offer that continued strong financial “safety net” for farm operators in the future. The overall farm economy is quite strong right now and will likely remain at positive levels into 2023; however, as was pointed out there are some reasons to be concerned about farm profit levels in the future. One of the best hedges for farm operators against reduced farm profits in the coming years is to keep the “current position” (cash available) segment of the farm business strong. It may be better to use current excess cash revenues from the farm operation to pay down short-term farm operating debt, rather than using the cash to purchase expensive land and other capital assets, or for excessive spending for non-farm expenditures. Farmers need to continue to look for ways to optimize production costs and to “fine-tune” grain and livestock marketing plans based on the “cost of production” in their farm operation. Even though we could face “strong headwinds” in the coming years, we do not necessarily need to repeat the ag financial crisis of the 1980’s.

0 Comments

Read More

Leave a Reply. |

Contact Us:

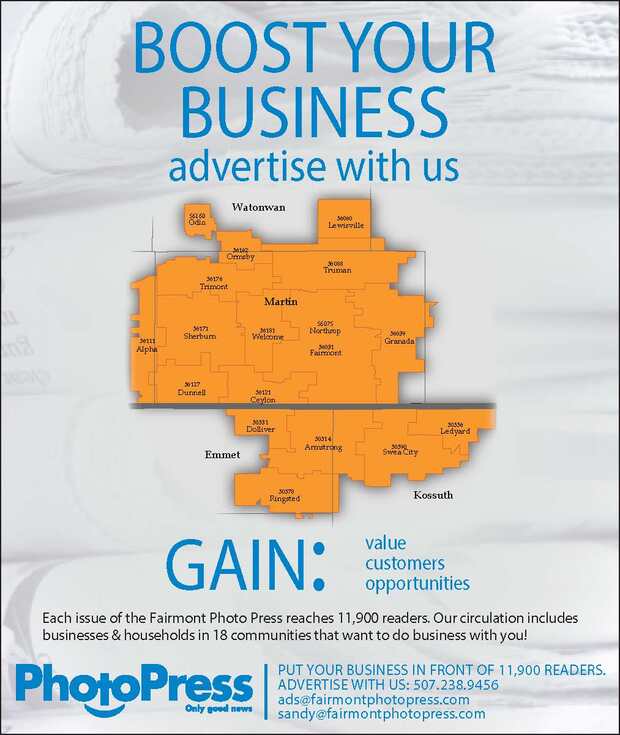

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed