AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

The 2023 crop year will be the final year for the current Farm Bill, which is set to expire on September 30, 2023, unless there is an extension. A Farm Bill is one of the most comprehensive pieces of legislation that is passed by Congress. Passage of a new Farm Bill is very complex, with programs ranging from farm commodity programs to food and nutrition programs, from conservation programs to rural development programs, and several more. In many cases, finalizing a Farm Bill in Congress can be quite controversial, and not necessarily just by political party lines. The Farm Bill programs become quite geographical, with members of Congress wanting to protect the farm, food, conservation, and economic interests of their State or Congressional district.

Following are a few insights on some of the key provisions that are included in the current Farm Bill: Commodities The Commodity Title includes all commodity farm program payments, marketing assistance loans (MAL), and other crop subsidy payments. In the past two Farm Bills, crop producers have had the option to choose between the price-only “Price Loss Coverage” (PLC) and county yield revenue-based “Ag Risk Coverage” (ARC-CO) program, which has been an annual choice since the 2020 crop year. Some farm organizations would like to see increased crop reference prices and MAL loan rates, as well as to make some adjustments to the ARC-CO program payment formula. The “Dairy Margin Coverage” (DMC) program, which has proved to be quite beneficial for small to medium sized dairy herds (under 300 cows), is also included under this Title and was enhanced in the 2018 Fam Bill. Crop Insurance Most crop producers and ag lenders will highlight a sound working crop insurance program through the USDA Risk Management Agency (RMA) as the “centerpiece” for a solid risk management plan in a farm operation. Over 95 percent of the corn and soybean acres in the Upper Midwest are typically insured by some type of crop insurance coverage, which are subsidized at a rate of 60-65 percent by the federal government. The RMA also offers some insurance products the dairy and livestock producers. Some members of Congress are calling for some changes and modifications to the current programs under this Title, while most farm organizations are lobbying to keep the current program intact. Some livestock organizations would like to see enhancements to RMA programs for livestock production. Conservation The current Farm Bill set the maximum Conservation Reserve Program (CRP) acres at 27 million acres, with additional focus on the Grassland Reserve Program. The Farm Bill also set the maximum CRP rental rates at 90 percent (90%) of the average FSA “prevailing” rental rates for Continuous CRP contracts and at 85 percent (85%) for General CRP. There will likely be considerable support for expansion of the maximum CRP acres, as well as for increasing the maximum annual CRP rental rates to incentivize enrollment into the CRP program. The large 2022 “Inflation Reduction Act” contained several provisions that provided added funding for the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP), which are part of the Conservation Title. Credit This Title sets parameters and provides funding for the FSA direct and guaranteed loan programs, which have become quite important to farm operators and ag lenders. The direct FSA farm ownership loans are especially important to provide beginning farmers low interest loans to purchase farmland. Recently, there have been greater efforts to reach underserved farmers and ranchers with the FSA loan programs. Nutrition The Nutrition Title, which includes the SNAP program (food stamps), the Women, Infants and Children (WIC) nutrition program, and school lunch program, will probably be debated more than any other Title during Farm Bill hearings in 2023. The Nutrition Title will likely account for 80-85 percent of annual federal spending allocated under the next Farm Bill. Several billion dollars were added to the Nutrition Title budget base as part of COVID relief legislation and the 2022 Inflation Reduction Act. Some members of Congress would like to separate the Nutrition Title from the Farm Bill; however, ag policy experts have warned that funding for ag commodity programs could become much more difficult if SNAP and the other nutrition programs are removed from the Farm bill legislation. Other Farm Bill Titles There are seven other Titles in the current Farm Bill that authorize programs and funding that is administered by USDA. These Titles and programs include: Rural Development This Title reauthorizes funding for rural development loans to communities and businesses, as well as programs to assist local governments with everything from emergency service providers, fire protection, wastewater treatment, expansion of broadband service, and more. Trade Includes funding for important agricultural trade promotion programs, such as the Market Access Program (MAP) and the Foreign Market Development Program (FMDP). These trade related programs are important for opening new markets and maintaining existing markets for U.S. ag exports. Energy Provides funding for USDA programs that support the development of biofuels and renewable energy. There may be efforts to include other “green energy” programs in the Farm Bill. Forestry Creates programs and provides funding for USDA collaborative efforts to battle forest fires, as well as for research and development, insect and disease control, and timber management. Horticulture Provides USDA funding for farmers markets and other local food programs, as well as for the national organic certification program. The last Farm Bill legitimized industrial hemp as an agricultural commodity, thus making hemp eligible for crop insurance and other USDA programs. Research and Extension USDA funding for ag research, extension programs, and other food research and education programs through the nation’s Land Grant University system are provided under this Title. Miscellaneous This Title covers any other programs offered by USDA, such as the provision in the last Farm Bill to provide funding for a foot-and-mouth disease (FMD) vaccine bank. Farm Bill “Baseline Funding” and Summary The amount of dollars that Congress allocates to a Farm Bill over a 10-year period is known as the “baseline funding”. This becomes very important in determining what the funding level is for each Title and the various programs in the Farm Bill. The current 2018 Farm Bill authorized $860 billion over ten years (2018-2027), with 76 percent going to nutrition, 9 percent to crop insurance, 7 percent each to commodity programs and conservation, and less than one percent to all other Titles. The initial “baseline funding for the 2023 Farm Bill proposes $1.3 trillion over ten years (2023-2032), with 84 percent for Nutrition, 6 percent for conservation, 5 percent for crop insurance, 4 percent for commodity programs, and less than one percent for the other Titles. Both the U.S. Senate and U.S. House Ag Committees held hearings on a new Farm Bill during 2022 and more hearings will likely be planned early in the new Congressional session in 2023. The Congressional leadership has been very committed with plans to have a new Farm Bill completed by September 30, 2023, with very little talk of an extension to the current Farm Bill. Ultimately, there will likely be a compromise reached, and a new 5-year Farm Bill will be passed; however, given the political division that currently exists in Congress, a one-year extension of the current Farm Bill is certainly a possibility. For additional information contact Kent Thiesse, Farm Management Analyst and Sr. Vice President, MinnStar Bank, Lake Crystal, MN. (Phone - (507) 381-7960) E-mail - [email protected]) Web Site - http://www.minnstarbank.com/

0 Comments

Read More

Leave a Reply. |

Contact Us:

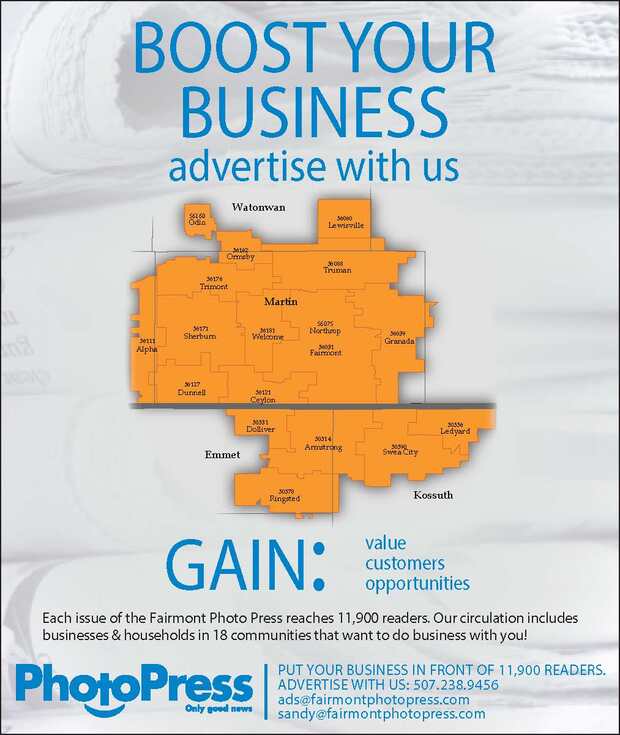

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed