AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

As we head into 2023, many farm operations are coming off a fairly good profit year in 2022; however, some producers had much more modest profit levels last year. In all cases, all farm operators are facing much higher crop and livestock input expenses in 2023, as compared to 2020 or 2021 expense levels. During these changing farm financial times, it is good to plan ahead before meeting with an ag lender for renewal of a farm operating line of credit or for an annual review of the farm financial portfolio.

Following are some tips for farm operators to be more proactive, as they are preparing for an annual meeting with their ag lender …… • Prepare an up-to-date 2022 year-end farm balance sheet (as of 12-31-22 or 1-01-23) . Preparation of an accurate and up-to-date year-end balance sheet is critical to the loan renewal process for any farm operation. Updating the previous year’s balance sheet with current year-end numbers can help expediate the process. If the farm operation is a sole proprietorship, most ag lenders will also want personal asset and liability data included. If it is a partnership or family corporation, most ag lenders will also require per-sonal balance sheets from all partners. A good year-end balance sheet will include: List of accounts receivable as of 12-31-22, which includes whom the money is due from, the dollar amount, and the date it will be received. This includes deferred payments for grain sold in 2022. List of accounts payable as of 12-31-21, listing who the money is owed to, the dollar amount, and when payment will be due. List of 2023 prepaid expenses for both crops and livestock as of 12-31-22, which details the input, amount of the input, and the amount that was prepaid. This for items where payment has occurred. Grain and livestock inventory list as of 12-31-22. The grain inventory should include total bushels of each crop, bushels that are forward priced (date and price for each sale), and any sales plans for the remaining bushels. Livestock inventory should include the number, weight, and any sales information on market or feeder livestock. An updated list and estimated value of breeding livestock should be included as an intermediate asset rather than a current asset. CCC loans on 2022 grain that were taken prior to 1-01-23, listing the bushel amount, CCC loan rate, CCC interest rate, CCC loan maturity date, and sales plans for the CCC grain. Review the list of farm machinery and equipment, buildings and facilities, and other capital assets, removing any assets that have been sold or removed, and adding any assets that were purchased or acquired during 2022. Farm machinery is usually listed as an intermediate asset. Add any land or other long-term assets that were added in 2022 and adjust asset values as necessary (may want to review this with an ag lender). List of all other loans and creditors as of 12-31-22, listing the principal balance, interest rate, payment amount, and payment dates. Be sure to include short-term creditors for crop inputs, loans with family members, and CCC loans through FSA offices. • Prepare a 2022 year-end income and expense statement as of 12-31-22. The year-end income statement from the previous year should be based on actual sales of grain and livestock during 2022, which will likely include both some 2021 inventory that existed at the beginning of the year, as well as any 2022 grain or livestock that was sold during the year. The 2022 expenses would include any accounts payable from the beginning of the year balance sheet that were paid in 2022 and any 2023 prepaid expenses that were paid in 2022, in addition to the other 2022 crop and livestock expenses. A preliminary 2022 federal tax return is a good resource to prepare an income statement. • Prepare a budget-to-actual summary for the previous year (as of 12-31-22). Once the 2022 income and expense statement has been finalized, and accrual adjustments are made based on the year-end balance sheet, it always good to review the actual year-end financial analysis compared to the budgeted cash flow analysis that was prepared at the beginning of the year. Pay attention to the big differences that exist in crop and livestock income and the various expense items, as well as determine explanations for those differences. Analyze for any potential adjustments that are needed for 2023. • Prepare a preliminary 2023 budget and cash flow analysis. Preparing an accurate and complete budget and cash flow analysis for 2023 is a very important part of the loan renewal process. A high-quality cash flow analysis will likely include: A grain and livestock marketing plan that includes a list of the amount sold, the contracted price, and the date to be delivered, as well as plans for remaining unpriced grain and livestock inventories. Planned crop and livestock production for the year, including acres of various crops, anticipated production levels, and any current or planned sales of the 2023 production. A list of planned crop and livestock inputs for 2023, the contracted or planned price of the inputs, and when the expense will be incurred. A detailed list of rented farm land for 2023, which includes the name of the farm owner, acres rented, amount of rent (including flexible lease details), and dates when rent payments are due. Include income received for accounts receivable on the year-end balance sheet and account for the expenses of any accounts payable at the beginning of the year. Provide details of planned 2023 crop insurance coverage, such as updated APH yields, percentage coverage, enterprise versus optional units, ad the addi-tion of hail or wind insurance. (Your ag lender may be a good resource for these decisions.) Provide a copy of FSA farm program information listing the crop base acres and FSA program yield for each farm unit. Discuss the 2023 farm program choice with your ag lender. Include any planned changes or adjustments in the farming operation for 2023 in the cash flow analysis, including farm machinery purchases or sales, adding or selling land or other assets, and any other changes to the farm business, as well as any changes in personal assets or liabilities. It is best to include all partners and family members that are part of the farm operation in the renewal process with an ag lender, so that all key players are “on the same page” with financial decisions affecting the farm business. It is very important to be trustworthy and honest in preparing and sharing financial information with an ag lender to help assure confidence in the accuracy of the financial data. View an ag lender as an informal partner in a farm business, as a good ag lender can be a valuable resource in making management decisions. Farm operators should expect their ag lenders to be well prepared, trustworthy and honest in financial dealings. It is important to remember that most local ag lenders also face a lot of pressure in the process of renewing farm operating loans. They need to do their “due-diligence” to complete the necessary requirements in the loan renewal process. The loan renewal process and documentation that is prepared will likely be reviewed by senior management at a financial institution, as well as being subject to review and audits by Federal and State bank examiners. Most ag lenders are part of the local community and want to see farmers have financial success, which is in the best interest of both the farm business and the ag lending institution.

0 Comments

Read More

Leave a Reply. |

Contact Us:

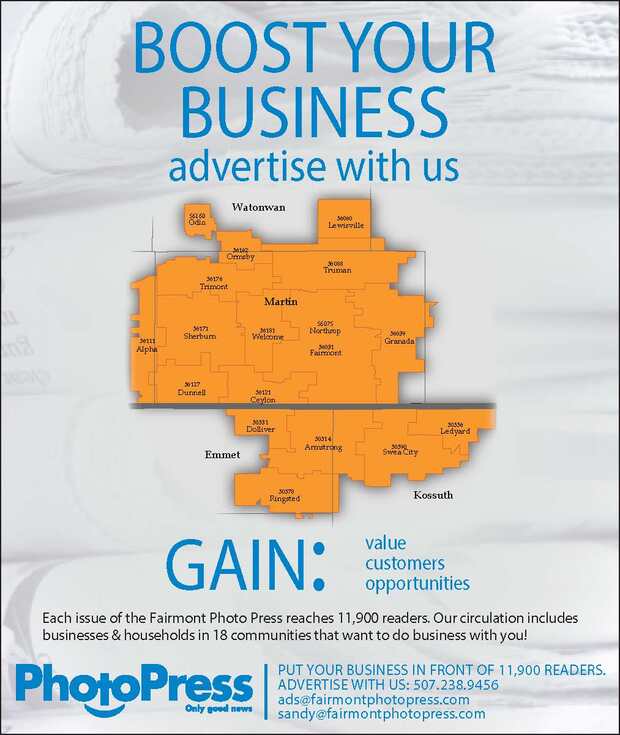

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed