AuthorThe “FOCUS ON AG” column is sent out weekly via e-mail to all interested parties. The column features timely information on farm management, marketing, farm programs, crop insurance, crop and livestock production, and other timely topics. Selected copies of the “FOCUS ON AG” column are also available on “The FARMER” magazine web site at: https://www.farmprogress.com/focus-ag Archives

July 2024

Categories |

Back to Blog

The monthly USDA World Supply and Demand Estimates (WASDE) report released on January 12 was viewed as “bullish” by most grain marketing analysts and had an immediate positive effect on corn and soybean prices. The January WASDE Report, which is often known as a “market mover”, showed some noteworthy adjustments to final 2022 corn and soybean production and supply number; however, the report also showed a slight decrease in corn and soybean demand for the coming year. The immediate market reaction following the release of the WASDE report for corn and soybean prices on the Chicago Board of Trade (CBOT) was quite positive.

CORN The final National Ag Statistics Service (NASS) 2022 Crop Production Report was also released on January 12. The report estimated the final 2022 U.S. average corn yield at 173.3 bu./acre, which increased by one bushel per acre from the December estimate. The 2022 corn yield estimate compares to 176.7 bushels per acre in 2021 and 171.4 bushels per acre in 2020. Minnesota is estimated to have a final 2022 statewide average corn yield of 195 bushels, while Iowa is projected to have a final corn yield of 200 bushels per acre for 2022. Other estimated average corn yields for 2022 included Illinois at the record yield of 214 bushels per acre, Indiana at 190 bushels per acre, Ohio at 187 bushels per acre, Wisconsin at 180 bushels, and North Dakota at 131 bushels per acre. The drought-stricken States of Nebraska and South Dakota are projected to have final 2022 corn yields of 165 and 132 bushels per acre respectively. The latest WASDE report showed a slight decrease in the total 2022 U.S. corn production, which is now estimated at 13.73 billion bushels. This is decrease of 200 million bushels from the December estimate and is over 1.3 billion bushels below 2021 corn production level. The latest USDA report also put the total demand for corn usage in 2022-23 at just over 13.9 billion bushels, which is a decrease of over 1 billion bushels from 2021-22 corn usage figures. Corn export levels are projected to decrease by 546 million bushels in 2022-23, along with a decrease in corn used for feed of 443 million bushels and a decrease of 51 million bushels in corn used for ethanol production in the coming year. The January USDA listed the total available supply of corn available at 15.157 billion bushels, which compares to 16.333 billion bushels in January of 2022. USDA is now estimating 2022-2023 U.S. corn ending stocks at 1.242 billion bushels, which is a decrease of 15 million bushels from the December WASDE report. USDA was projecting 2021-22 corn ending stocks at just over 1.5 billion bushels a year ago in the January WASDE report; however, the final 2021-22 ending stocks closed at an estimated 1.377 billion bushels on August 31, 2022. The U.S. corn stocks-to-use ratio is now estimated at 8.9 percent for 2021-22, which would just below the 9.2 percent ratio for 2021-22 and just above 8.3 percent in 2020-21. The recent ratios compare to corn stocks-to-use ratios of 13.7 percent for 2019-20, 14.6 percent for 2018-19, and 14.5 percent in 2017-18. This means there could be potential for short-term rallies in the cash corn market in the coming months, especially in areas of the U.S. with tight supplies and high local corn demand. USDA is currently estimating the U.S average on-farm cash corn price for 2022-23 at $6.70 per bushel, which is at the same level as the December estimate. The projected 2022-23 market year average (MYA) corn price represents the highest WASDE estimated average corn price in nearly a decade. The 2022-23 USDA price estimates are the expected average farm-level prices for the 2022 crop from September 1, 2022, to August 31, 2023; however, they do not represent estimated prices for either the 2022 or 2023 calendar year. The current projected 2022-23 average price of $6.70 per bushel compares to national average corn prices of $6.00 per bushel in 2021-22, $4.53 per bushel in 2020-21, $3.57 per bushel for 2019-20, $3.61 per bushel for 2018-19, and $3.36 per bushel for both 2017-18 and 2016-17. SOYBEANS The latest NASS report estimates the final 2022 U.S. average soybean yield at 49.5 bushels per acre, which is down from the final U.S. average yields of 51.7 bushels per acre in 2021 and 51 bushels per acre in 2020. Total U.S. soybean production for 2022 is now estimated at 4.276 billion bushels, which is a decrease of 189 million bushels from final 2021 production levels. The recent WASDE report estimates total soybean demand at 4.355 billion bushels for the 2022-23 marketing year, which is a decline of 109 million bushels from 2021-22 soybean demand levels. Soybean crush levels are expected to increase by 41 million bushels in the current marketing year; however, soybean export levels are expected to decline by 168 million bushels during 2022-23. The U.S. soybean ending stocks for the 2022-23 marketing year in the latest WASDE Report are estimated at 210 million bushels, which was a decrease of 10 million bushels from the December WASDE report. The projected 2022-23 soybean ending stocks are a decrease of 23 percent from the estimated 2021-22 carryout level of 274 million bushels. The projected 2022-23 soybean ending stocks compare to other recent year-end carryout levels of 257 million bushels for 2020-21, 525 million bushels for 2019-20, 913 million bushels for 2018-19, and 438 million bushels for 2017-18. The soybean stocks-to-use ratio for 2022-23 is now estimated at 4.8 percent, which would be the lowest level since 2.6 percent in 2013. The projected 2022-23 ratio compares to tight ratios of 6.1 percent for 2021-22 and 5.7 percent in 2020-21; however, the current ratio is considerably lower than soybean stocks-to-use ratios of 23 percent for 2018-19 and 13.3 percent for 2019-20. The expected rather tight soybean supply may offer some opportunities for continued strong cash soybean prices in the coming months, especially if weather issues develop in South America or with the 2023 U.S. soybean crop. USDA is now projecting the U.S. average farm-level soybean price for the 2022-2023 marketing year at $14.20 per bushel, which was an increase of $.20 per bushel from the December estimate. The estimated 2022-23 U.S. average soybean price would be the highest in nearly a decade. The 2022-23 soybean price estimate compares to other recent yearly average soybean prices of $13.30 per bushel for 2021-22, $10.80 per bushel for 2020-21, $8.57 per bushel for 2019-20, $8.48 per bushel for 2018-19, and $9.35 per bushel for 2017-18. Marketing Decisions Many farm operators will tell you that grain marketing decisions are one of the hardest parts of farming, which is especially true during periods of highly volatile markets such as we have experienced the past two years. A year ago, December corn futures on the Chicago Board of Trade (CBOT) were below $5.60 per bushel for “new crop” 2022 corn, with a local 2022 Fall harvest prices in Southern Minnesota at just above $5.00 per bushel. By May, the futures price had risen to near $7.50 per bushel and the local harvest cash corn price to over $7.00 per bushel, with only a slight price decline for the balance of 2022. Similarly, CBOT November soybean futures for 2022 were just over $13.00 per bushel in January last year, with a local Southern Minnesota harvest price near $12.50 per bushel for the Fall of 2022. By June, the CBOT November futures price and some local cash soybean bids had risen above $15.00 per bushel, before declining slightly to just over $14.50 per bushel by year-end. During 2021 and 2022 many farmers began selling their anticipated corn and soybean production quite aggressively early in the year, once the local cash price got into a profitable price range, thus missing higher potential prices that occurred later in the year. Given the scenarios that existed prior to planting in both years, these were not bad marketing decisions to sell some of the anticipated crop production at profitable levels, in order to reduce risk. Now producers are wondering what to do about protecting prices for the 2023 corn and soybean crop. Being able to “lock-in” local 2023 cash prices near $5.50 per bushel for corn and over $13.00 per bushel for soybeans offer some of the best pre-plant marketing opportunities that we have seen in many years.

0 Comments

Read More

Leave a Reply. |

Contact Us:

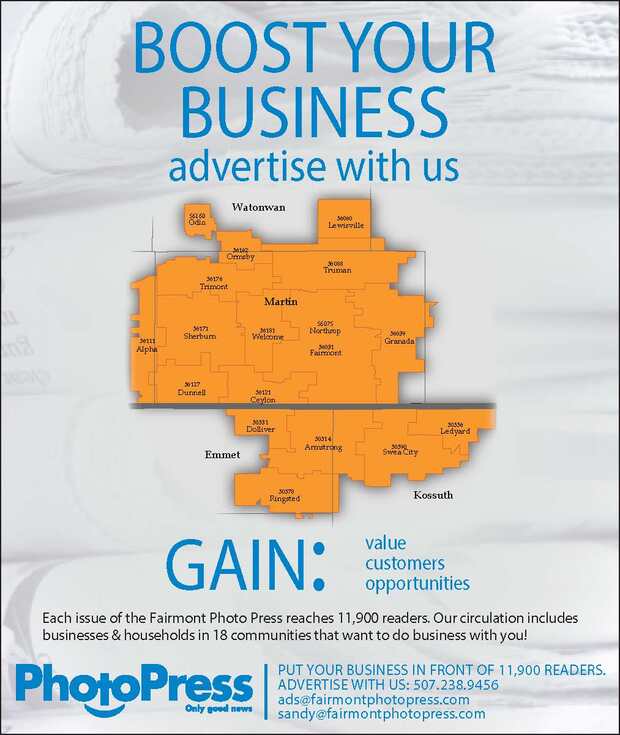

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Phone: 507.238.9456

e-mail: [email protected]

Photo Press | 112 E. First Street |

P.O. Box 973 | Fairmont, MN 56031

Office Hours:

Monday-Friday 8:00 a.m. - 4:00 p.m.

Proudly powered by Weebly

RSS Feed

RSS Feed